UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

☐ Preliminary information statement

☐ Confidential, for use of the Commission only (as permitted by Rule 14c-6(d)(2))

☒ Definitive information statement

|

ARCH THERAPEUTICS, INC. |

(Name of Registrant as specified in Its Charter)

Payment of filing fee (check the appropriate box):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and 0-1

ARCH THERAPEUTICS, INC.

235 Walnut Street, Suite 6

Framingham, MA 01702

(617) 431-2313

NOTICE OF ACTION TAKEN BY WRITTEN CONSENT OF THE MAJORITY STOCKHOLDERS IN LIEU OF A MEETING

Dear Stockholders:

This Notice and the accompanying Information Statement are being furnished on or about September 1, 2023, by the Board of Directors (the “Board”) of Arch Therapeutics, Inc., a Nevada corporation (the “Company”), to the holders of the Company’s common stock, par value $0.001 per share (the “Common Stock”), as of the close of business on July 18, 2023 (the “Record Date”), for informational purposes only pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder.

The purpose of this Information Statement is to inform the Company’s stockholders of certain actions taken by the written consent of the holders of a majority of the Company’s outstanding voting stock (the “Majority Stockholders”), dated as of August 22, 2023, in lieu of a meeting, and which will be effective 20 calendar days from the date of mailing this Information Statement to you. The Majority Written Consent of Stockholders in Lieu of a meeting dated August 22, 2023 (the “Written Consent”) authorizes the following corporate actions (together, the “Corporate Actions”):

|

(1) |

An amendment to the Company’s Amended and Restated Articles of Incorporation (the “Articles of Incorporation” or “Charter”) to effectively increase the number of authorized shares of Common Stock from 12,000,000 to 350,000,000 shares of Common Stock (the “Authorized Share Increase”). |

|

(2) |

The granting of discretionary authority to the Board, at any time for a period of 12 months after the date of the Written Consent, to authorize the adoption of an amendment to the Company’s Charter to implement a reverse stock split of the Company’s issued and outstanding Common Stock, at a ratio of not less than 1.5-for-1 and not greater than 20-for-1 without a corresponding decrease to the Company’s authorized shares of Common Stock (the “Reverse Split Ratio”) at any time prior to August 22, 2024, with the exact ratio to be determined by the Board (the “Reverse Split”). |

|

(3) |

An amendment to the Company’s Charter to authorize 5,000,000 shares of “blank check” preferred stock, $0.001 par value, in such series and classes, and with such rights and privileges as the Board may hereafter adopt in its sole discretion. |

|

(4) |

The approval of the Company’s Amended and Restated 2023 Equity Incentive Plan (the “Plan”). |

The Board believes it would not be in the best interests of our Company and our stockholders to incur the costs of soliciting proxies or consents from additional stockholders in connection with these actions.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING YOU OF THE MATTERS DESCRIBED HEREIN.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

No action is required by you. The Corporate Actions cannot become effective until twenty (20) days after the date this Information Statement is mailed to the Company’s stockholders. Therefore, we anticipate that the Corporate Actions will become effective on or after September 21, 2023. This Notice and the accompanying Information Statement are being furnished only to inform our stockholders of the Corporate Actions in accordance with the Nevada Revised Statutes, our Bylaws and Rule 14c-2 of the Exchange Act.

PLEASE NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED HEREIN.

By Order of the Board of Directors,

| /s/ Terrence W. Norchi, MD | |

| Terrence W. Norchi, MD | |

| President and Chief Executive Officer |

Dated: September 1, 2023

Framingham, Massachusetts

TABLE OF CONTENTS

|

GENERAL INFORMATION |

5 |

|

QUESTIONS AND ANSWERS ABOUT THIS INFORMATION STATEMENT AND THE TRANSACTIONS |

6 |

|

INFORMATION ON MAJORITY STOCKHOLDERS |

6 |

|

NO APPRAISAL OR DISSENTERS’ RIGHTS |

6 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

7 |

|

ITEM 1 - APPROVAL OF AMENDMENT TO INCREASE OF THE COMPANY’S AUTHORIZED SHARES OF COMMON STOCK FROM 12,000,000 TO 350,000,000 SHARES OF COMMON STOCK |

10 |

|

ITEM 2 - THE GRANTING OF DISCRETIONARY AUTHORITY TO THE BOARD, AT ANY TIME FOR A PERIOD OF 12 MONTHS AFTER THE DATE OF THE WRITTEN CONSENT, TO AUTHORIZE THE ADOPTION OF AN AMENDMENT TO THE COMPANY’S CHARTER, TO EFFECT A REVERSE STOCK SPLIT OF THE ISSUED AND OUTSTANDING COMMON STOCK AT A RATIO BETWEEN 1.5 FOR 1 TO 20 FOR 1 WITHOUT CORRESPONDINGLY DECREASING THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK, SUCH RATIO TO BE DETERMINED BY THE BOARD, OR TO DETERMINE NOT TO PROCEED WITH THE REVERSE STOCK SPLIT |

15 |

|

ITEM 3 - AUTHORIZATION TO AMEND THE COMPANY’S ARTICLES OF INCORPORATION TO AUTHORIZE PREFERRED SHARES OF FIVE MILLION (5,000,000), $0.001 PAR VALUE PER SHARE, IN SUCH CLASSES OR SERIES WITH SUCH RIGHTS, PRIVILEGES AND PREFERENCES AS THE BOARD MAY HEREAFTER DETERMINE IN ITS SOLE DISCRETION |

20 |

|

ITEM 4 - ADOPTION OF THE AMENDED AND RESTATED 2023 EQUITY INCENTIVE PLAN |

21 |

|

EXECUTIVE COMPENSATION |

27 |

|

DELIVERY OF DOCUMENTS TO STOCKHOLDERS SHARING AN ADDRESS |

33 |

|

FORWARD-LOOKING INFORMATION |

33 |

|

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON |

33 |

|

ADDITIONAL INFORMATION |

33 |

|

CONCLUSION |

34 |

|

EXHIBIT A |

A-1 |

|

EXHIBIT B |

B-1 |

|

EXHIBIT C |

C-1 |

|

EXHIBIT D |

D-1 |

INFORMATION STATEMENT PURSUANT TO SECTION 14(c) OF THE

SECURITIES EXCHANGE ACT OF 1934 AND REGULATION 14C PURSUANT THERETO

September 1, 2023

ARCH THERAPEUTICS, INC.

235 Walnut Street, Suite 6

Framingham, MA 01702

(617) 431-2313

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT HAVE BEEN APPROVED BY A MAJORITY OF THE VOTING POWER OF OUR COMMON STOCK.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL INFORMATION

This Information Statement has been filed with the Securities and Exchange Commission (the “SEC”) and is being furnished on or about September 1, 2023, by the Board of Directors (the “Board”) of Arch Therapeutics, Inc., a Nevada corporation (the “Company”), to the holders of common stock, par value $0.001 per share (the “Common Stock”), as of the close of business on July 18, 2023 (the “Record Date”), pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations prescribed thereunder.

On July 18, 2023, the Board deemed it in our best interests to take the following corporate actions (the “Corporate Actions”) and submit them to our stockholders for approval:

|

(1) |

An amendment to the Company’s Amended and Restated Articles of Incorporation (the “Articles of Incorporation” or “Charter”) to effectively increase the number of authorized shares of Common Stock from 12,000,000 to 350,000,000 shares of Common Stock (the “Authorized Share Increase”). |

|

(2) |

The granting of discretionary authority to the Board, at any time for a period of 12 months after the date of the Written Consent, to authorize the adoption of an amendment to the Company’s Charter to implement a reverse stock split of the Company’s issued and outstanding Common Stock, at a ratio of not less than 1.5-for-1 and not greater than 20-for-1 without a corresponding decrease to the Company’s authorized shares of Common Stock (the “Reverse Split Ratio”) at any time prior to August 22, 2024, with the exact ratio to be determined by the Board (the “Reverse Split”). |

|

(3) |

An amendment to the Company’s Charter to authorize 5,000,000 shares of “blank check” preferred stock, $0.001 par value, in such series and classes, and with such rights and privileges as the Board may hereafter adopt in its sole discretion. |

|

(4) |

The approval of the Company’s Amended and Restated 2023 Equity Incentive Plan (the “Plan”). |

We are also providing notice to our stockholders that the Corporate Actions were taken by written consent (the “Written Consent”) of the holders of a majority of the Company’s outstanding voting stock (the “Majority Stockholders”), dated as of August 22, 2023, in lieu of a meeting. The purpose of this Information Statement is to inform our stockholders that the Board considers the Corporate Actions to be in the best interests of our Company and our stockholders and that such Corporate Actions will be effective 20 calendar days from the date of mailing this Information Statement to you pursuant to Rule 14c-2 of the Exchange Act.

The amendments to effect the Authorized Share Increase, Reverse Split, and authorization of “blank check” preferred stock are attached hereto as Exhibits A, B, and C, respectively. The Plan is attached hereto as Exhibit D.

QUESTIONS AND ANSWERS ABOUT

THIS INFORMATION STATEMENT AND THE TRANSACTIONS

|

Q. |

Why did I receive this Information Statement? |

|

A. |

The Exchange Act requires us to provide you with information regarding the Corporate Actions, even though your vote is neither required nor requested to approve the Corporate Actions. |

|

Q. |

Why am I not being asked to vote on the Corporate Actions? |

|

B. |

The Board unanimously adopted, approved and recommended the approval of the Corporate Actions and determined that the Corporate Actions are advisable and in the best interests of the Company and our stockholders. The Corporate Actions have also been approved by the Written Consent of the Majority Stockholders. Such approval is sufficient under the Nevada Revised Statutes and our Bylaws and no further approval by our stockholders is required. Therefore, your vote is not required and is not being sought. We are not asking you for a proxy and you are requested not to send us a proxy. |

|

Q. |

What do I need to do now? |

|

C. |

Nothing. This Information Statement is provided to you solely for your information and does not require or request you to do anything. |

INFORMATION ON MAJORITY STOCKHOLDERS

Under Section 78.320 of the Nevada Revised Statutes and our Bylaws, the written consent of stockholders holding a majority of the voting power allocated to our voting shares may be substituted for an annual or special meeting of the stockholders, provided that such written consent sets forth the action so taken and is signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote upon were present and voted.

Our Common Stock is the only class of outstanding voting stock of the Company. As of the Record Date, there were:

i. 3,034,458 shares of Common Stock outstanding, with one vote per share;

As of the Record Date, the Common Stock provides for a total of 3,034,458 voting shares. A total of 1,517,230 votes were required to pass any stockholder resolution.

As of the Record Date, the Majority Stockholders together owned 1,564,555 shares of the Company’s voting shares, representing approximately 51.56% of the voting power of the outstanding shares of capital stock of the Company.

All outstanding shares are fully paid and nonassessable. There are no cumulative voting rights. No consideration was paid for the consent. The transfer agent for our Common Stock is Empire Stock Transfer, 1859 Whitney Mesa Drive, Henderson, NV 89014.

NO APPRAISAL OR DISSENTERS’ RIGHTS

Stockholders are not entitled to dissenter’s rights of appraisal with respect to any of the Corporate Actions under the Nevada Revised Statutes, our Articles of Incorporation, or our Bylaws.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of the Record Date, there were 3,034,458 shares of Common Stock outstanding.

The following table sets forth, as of the Record Date, ownership of our voting securities that are beneficially owned by:

|

● |

each person, or group of affiliated persons, known by us to beneficially own more than 5% of any class of our voting securities; |

|

● |

each of our named executive officers; |

|

● |

each of our directors; and |

|

● |

all of our named executive officers and directors as a group. |

Information relating to beneficial ownership of the voting securities by our principal stockholders and management is based upon each person’s information using “beneficial ownership” concepts under the SEC rules. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. For purposes of computing the number and percentage of shares beneficially owned by a security holder, any shares which such person has the right to acquire within 60 days of the Record Date, are deemed to be outstanding, but those shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other security holder.

Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, ownership consists of sole ownership, voting and investment rights, and the address for each stockholder listed is: c/o Arch Therapeutics, Inc., 235 Walnut St., Suite #6, Framingham, Massachusetts 01702.

|

Amount of Beneficial |

||||||||

|

Name and Address of Beneficial Holder |

Number of |

Percent of |

||||||

|

5% Stockholders |

||||||||

|

Oasis Capital, LLC (1) |

300,000 | 9.89 |

% |

|||||

|

Bigger Capital Fund, LP & District 2 Capital Fund LP(2) |

300,000 | 9.89 |

% |

|||||

|

Walleye Opportunities Master Fund Ltd(3) |

300,000 | 9.89 |

% |

|||||

|

Cavalry Fund I LP (4) |

300,000 | 9.89 |

% |

|||||

|

Brandt & Mona Wilson (5) |

300,000 | 9.89 |

% |

|||||

|

Sixth Borough Capital Fund, LP (6) |

300,000 | 9.89 |

% |

|||||

|

Named Executive Officers and Directors |

||||||||

|

Terrence Norchi, Chief Executive Officer (7) |

105,567 | 3.44 |

% |

|||||

|

Punit Dhillon (8) |

5,556 | * | ||||||

|

Laurence Hicks (9) |

11,333 | * | ||||||

|

Michael Abrams (10) |

12,417 | * | ||||||

|

Daniel Yrigoyen (11) |

2,917 | * | ||||||

|

Guy Fish (12) |

1,736 | * | ||||||

|

Named Officers and Directors as a Group |

139,526 | 4.50 |

% |

|||||

* Indicates less than 1% of class.

|

(1) |

Represents 300,000 shares of Common Stock owned by Oasis Capital, LLC. Excludes (a) 131,292 First Conversion Shares; (b) 120,725 First Warrants; (c) 27,353 Second Conversion Shares; (d) 50,302 Second Warrants; (e) 76,886 Third Conversion Shares; (f) 141,396 Third Warrants; (g) 1,005,251 Pre-Funded Warrants; and (h) 2,552,766 Common Warrants, all of which are subject to conversion or exercise restrictions that prohibit conversion or exercise until such time as the holder would not beneficially own, after such conversion or exercise, more than 4.99% or 9.99% (as the case may be) of the outstanding shares of Common Stock; provided, however, that the holder may waive such ownership limitation, in which case any waiver would become effective sixty-one (61) days after the holder’s delivery of such waiver notice. As of the Record Date, Oasis Capital, LLC has not waived such limitation. |

|

(2) |

Represents 300,000 shares of Common Stock owned by, and split evenly between, Bigger Capital Fund, LP and District 2 Capital Fund LP with a common control person. Excludes (a) 131,292 First Conversion Shares; (b) 120,726 First Warrants; (c) 27,354 Second Conversion Shares; (d) 50,302 Second Warrants; (e) 989,459 Pre-Funded Warrants; and (f) 2,552,652 Common Warrants held in the aggregate by Bigger Capital Fund, LP and District 2 Capital Fund LP, all of which are subject to conversion or exercise restrictions that prohibit conversion or exercise until such time as the holder would not beneficially own, after such conversion or exercise, more than 4.99% or 9.99% (as the case may be) of the outstanding shares of Common Stock; provided, however, that the holder may waive such ownership limitation, in which case any waiver would become effective sixty-one (61) days after the holder’s delivery of such waiver notice. As of the Record Date, neither Bigger Capital Fund, LP, nor District 2 Capital Fund LP has waived such limitation. |

|

(3) |

Represents 300,000 shares of Common Stock owned by Walleye Opportunities Master Fund Ltd. Excludes (a) 976,278 Pre-Funded Warrants; and (b) 2,552,556 Common Warrants, all of which are subject to exercise restrictions that prohibit exercise until such time as the holder would not beneficially own, after such exercise, more than 4.99% or 9.99% (as the case may be) of the outstanding shares of Common Stock; provided, however, that the holder may waive such ownership limitation, in which case any waiver would become effective sixty-one (61) days after the holder’s delivery of such waiver notice. As of the Record Date, Walleye Opportunities Master Fund Ltd has not waived such limitation. |

|

(4) |

Represents 300,000 shares of Common Stock owned by Cavalry Fund I LP. Excludes (a) 52,517 First Conversion Shares; (b) 48,290 First Warrants; (c) 10,941 Second Conversion Shares; (d) 20,121 Second Warrants; (e) 985,064 Pre-Funded Warrants; and, (f) 2,552,620 Common Warrants, all of which are subject to conversion or exercise restrictions that prohibit conversion or exercise until such time as the holder would not beneficially own, after such conversion or exercise, more than 4.99% or 9.99% (as the case may be) of the outstanding shares of Common Stock; provided, however, that the holder may waive such ownership limitation, in which case any waiver would become effective sixty-one (61) days after the holder’s delivery of such waiver notice. As of the Record Date, Cavalry Fund I LP has not waived such limitation. |

|

(5) |

Represents 300,000 shares of Common Stock owned individually by Brandt and Mona Wilson. Excludes (a) 976,278 Pre-Funded Warrants; and (b) 2,552,556 Common Warrants, all of which are subject to exercise restrictions that prohibit exercise until such time as the holder would not beneficially own, after such exercise, more than 4.99% or 9.99% (as the case may be) of the outstanding shares of Common Stock; provided, however, that the holder may waive such ownership limitation, in which case any waiver would become effective sixty-one (61) days after the holder’s delivery of such waiver notice. As of the Record Date, neither Brandt Wilson nor Mona Wilson had waived such limitation. |

|

(6) |

Represents 300,000 shares of Common Stock owned by Sixth Borough Capital Fund, LP. Excludes (a) 63,869 Pre-Funded Warrants; and (b) 727,738 Common Warrants, all of which are subject to exercise restrictions that prohibit exercise until such time as the holder would not beneficially own, after such exercise, more than 4.99% or 9.99% (as the case may be) of the outstanding shares of Common Stock; provided, however, that the holder may waive such ownership limitation, in which case any waiver would become effective sixty-one (61) days after the holder’s delivery of such waiver notice. As of the Record Date, Sixth Borough Capital Fund, LP has not waived such limitation. |

|

(7) |

Represents (a) 50,000 shares of Common Stock held by Twelve Pins Partners, LLC, with respect to which Dr. Norchi is the sole member and holds sole voting and investment control; (b) 7,098 shares issued to Dr. Norchi upon the closing of the Merger in exchange for the cancellation of shares of Common Stock and convertible notes of ABS owned by him immediately prior to the closing of the Merger; (c) 5,650 shares of restricted stock granted to Dr. Norchi on May 3, 2016; (d) 3,250 shares of restricted stock granted to Dr. Norchi on February 3, 2017; (e) 1,800 shares of restricted stock granted to Dr. Norchi on July 19, 2018; (f) 2,626 First Conversion Shares; (g) 2,415 First Warrants; and (h) 363 First Inducement Shares; and (i) 32,365 shares subject to options exercisable within 60 days after the Record Date. Dr. Norchi disclaims beneficial ownership of the securities held by Twelve Pins Partners, LLC except to the extent of his pecuniary interest therein. |

|

(8) |

Represents 5,556 shares of Common Stock subject to options exercisable within 60 days after the Record Date. |

|

(9) |

Represents 3,091 shares of Common Stock subject to options exercisable within 60 days after the Record Date. Includes (i) 137 shares of Common Stock, (ii) 3,939 First Conversion Shares, (iii) 3,622 Warrant Shares, and (iv) 544 First Inducement Shares held by Drake Partners Equity LLC, in which Mr. Hicks has an ownership interest. |

|

(10) |

Represents (i) 3,939 First Conversion Shares; (ii) 3,622 Warrant Shares; (iii) 544 First Inducement Shares; and (iv) 4,312 shares of Common Stock subject to options exercisable within 60 days after the Record Date. |

|

(11) |

Represents 750 shares of restricted stock granted to Mr. Yrigoyen on July 30, 2021, and 2,167 shares of Common Stock subject to options exercisable within 60 days after the Record Date. |

|

(12) |

Represents 1,736 shares of Common Stock subject to options exercisable within 60 days after the Record Date. |

ITEM 1 - APPROVAL OF AMENDMENT TO INCREASE OF THE COMPANY’S AUTHORIZED SHARES OF COMMON STOCK FROM 12,000,000 TO 350,000,000 SHARES OF COMMON STOCK

Our Charter currently authorizes the Company to issue a total of 12,000,000 shares of Common Stock, par value of $0.001 per share. The Board of Directors and Majority Stockholders, pursuant to the Written Consent, approved an amendment to our Charter to revise the total number of shares of Common Stock that the Company is authorized to issue from 12,000,000 to 350,000,000 shares of Common Stock (the “Authorized Share Increase”).

This effective increase would allow us to (i) maintain alignment with market expectations regarding the number of authorized shares of our Common Stock in comparison to the number of shares issued or reserved for issuance following any stock split, and ensure that we do not have what certain stockholders might view as an unreasonably high number of authorized shares which are not issued or reserved for issuance, (ii) provide us with the ability to pursue financing and corporate opportunities involving our Common Stock, which may include private or public offerings of our equity securities, and (iii) provide us with the ability to grant appropriate equity incentives for our employees over time. In addition, the Company currently has insufficient authorized shares of Common Stock to be issued upon the exercise of certain securities sold in the Bridge Offering (as defined below).

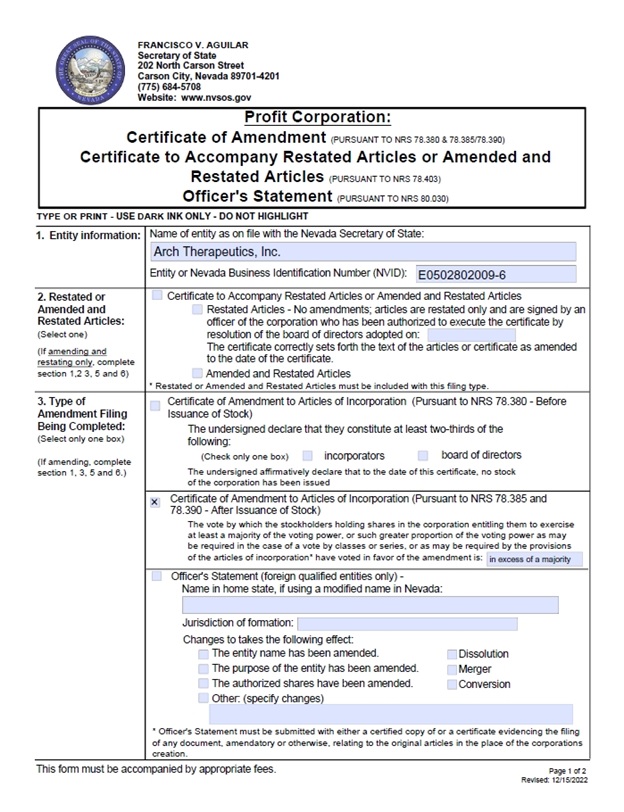

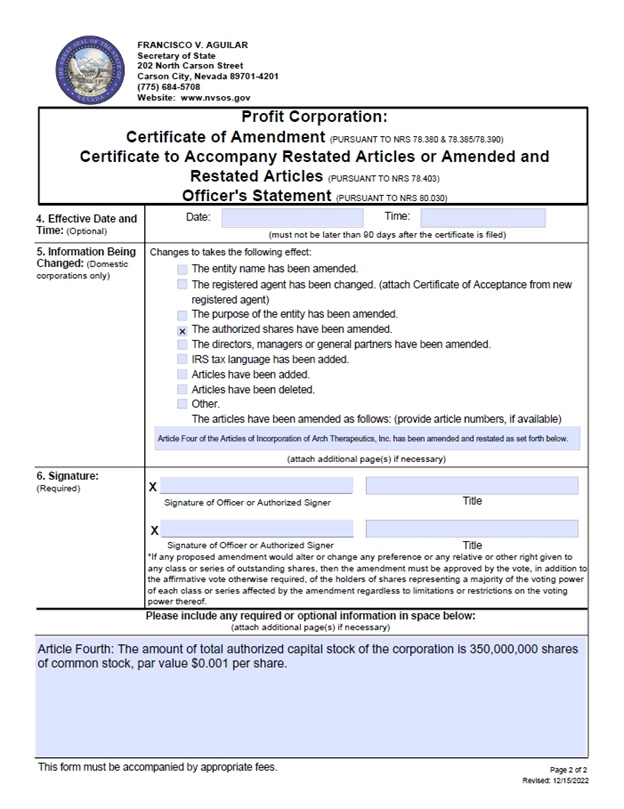

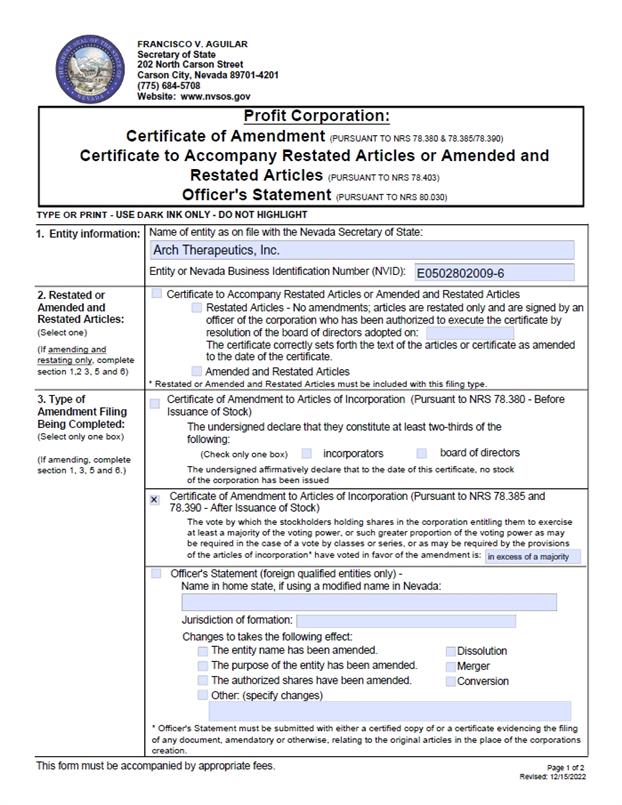

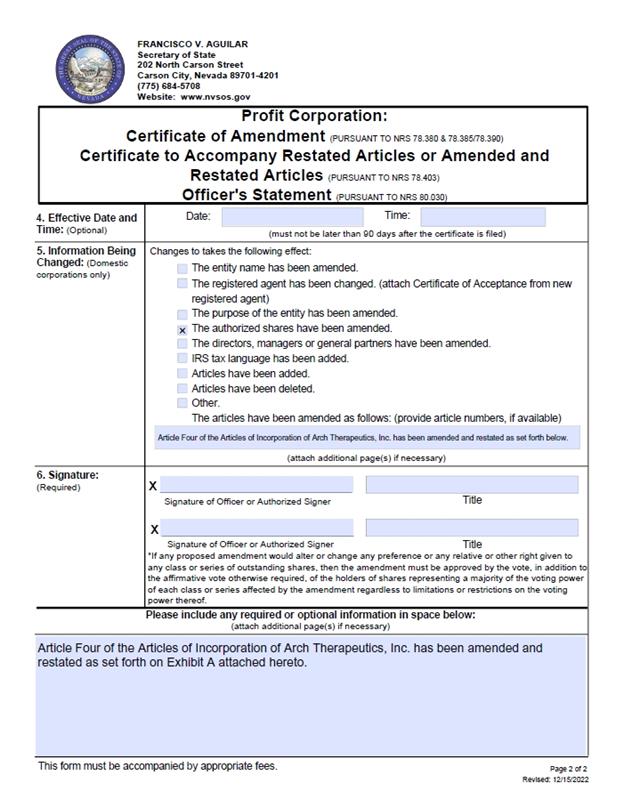

The text of the proposed amendment to the Company’s Charter to effect the Authorized Share Increase is included in Exhibit A to this Information Statement (the “Authorized Share Charter Amendment”). The Company will have the authority to file the Authorized Share Charter Amendment with the Secretary of State of the State of Nevada, which will become effective upon its filing; provided, however, that the Authorized Share Charter Amendment is subject to revision to include such changes as may be required by the office of the Secretary of State of the State of Nevada and as the Board deems necessary and advisable.

Purpose

The primary purpose of the Authorized Share Increase is to effectively increase the total number of shares that we are authorized to issue to (i) maintain alignment with market expectations regarding the number of authorized shares of our Common Stock in comparison to the number of shares issued or reserved for issuance following any reverse stock split and ensure that we do not have what certain stockholders might view as an unreasonably high number of authorized shares which are not issued or reserved for issuance, (ii) provide us with the ability to pursue financing and corporate opportunities involving our Common Stock, which may include private or public offerings of our equity securities, (iii) provide us with the ability to grant appropriate equity incentives for our employees over time and (iv) have sufficient reserves of Common Stock for issuance upon the exercise of securities sold in the Bridge Offering.

Bridge Offering

On July 7, 2023, the Company announced that it had entered into a Securities Purchase Agreement (the “SPA”) with certain institutional and accredited individual investors (collectively, the “Investors”) providing for the issuance and sale by the Company to the Investors of an aggregate of (i) 1,749,245 shares (the “Shares”) of Common Stock at a purchase price of $0.275 per share; (ii) 4,996,199 warrants (the “Pre-Funded Warrants”) at a purchase price of $0.274 per Pre-Funded Warrant, to purchase an aggregate of 4,996,199 shares of Common Stock (the “Pre-Funded Warrant Shares”); and (iii) 13,490,888 warrants (the “Common Warrants” and together with the Pre-Funded Warrants, the “Warrants”) to purchase an aggregate 13,490,888 shares of Common Stock (the “Common Warrant Shares” and together with the Pre-Funded Warrant Share, the “Warrant Shares”). The Shares, Pre-Funded Warrants, and Common Warrants were issued as part of a private placement offering authorized by the Company’s board of directors (the “Bridge Offering”).

Pursuant to the lock-up agreement provided for by the SPA, the Investors agreed that they would either (A) purchase securities, for cash, in an offering conducted in conjunction with an uplist of the Common Stock to any of, and in compliance with the rules of, the Nasdaq Global Market, Nasdaq Capital Market, New York Stock Exchange or NYSE American (the “Uplist Transaction”) with an aggregate purchase price equal to at least 4.3 multiplied by the aggregate purchase price paid by the Investor for the Shares and Warrants under the SPA or (B) be subject to a lock-up provision not to sell or otherwise transfer any of the Shares or Warrant Shares acquired by them in the Bridge Offering until the one-year anniversary of the Closing Date. The aggregate gross proceeds for the sale of the Shares, Pre-Funded Warrants, and Common Warrants will be approximately $1.85 million, before deducting the placement agent’s fees and other estimated fees and offering expenses payable by the Company. The closing of the sales of these securities under the SPA occurred on July 7, 2023 (the “Closing Date”).

Under the SPA, the Company also agreed that upon the closing of the next underwritten public offering of Common Stock (a “Qualifying Offering”) if the effective offering price to the public per share of Common Stock (the “Qualifying Offering Price”) is lower than the $4.00 per share, then the Company shall issue additional Pre-Funded Warrants in an amount reflecting a reduction in the purchase price paid for the Shares and Pre-Funded Warrants that equals the proportion by which the Qualifying Offering Price is less than the $4.00.

Placement Agent

The Company retained Dawson James Securities, Inc. (“DJ”) as placement agent in connection with the Bridge Offering. The Company paid DJ a cash fee equal to 8.0% of the aggregate gross proceeds of the Bridge Offering and reimbursement of expenses of $50,000. Additionally, the Company has agreed to issue to DJ, or its designees, warrants (the “Placement Agent Warrants”) to purchase that number of shares of Common Stock equal to 5% of the aggregate number of securities sold in the Bridge Offering (including warrant coverage). The Placement Agent Warrants will be exercisable at any time and from time to time, in whole or in part, during the five-year period commencing six months from the closing of the Bridge Offering, at a price per share equal to $0.275. The Placement Agent Warrants will provide for a cashless exercise provision and registration rights (including a one-time demand registration right and unlimited piggyback rights).

Use of Proceeds

The net proceeds to the Company from the Bridge Offering, after deducting the placement agent’s fees and the Company’s other estimated fees and offering expenses and excluding the proceeds, if any, from the exercise of the Warrants, are expected to be approximately $1.56 million. The Company intends to use the net proceeds from the Bridge Offering primarily for working capital and general corporate purposes and has not allocated specific amounts for any specific purposes.

Pre-Funded Warrants

The Pre-Funded Warrants will (i) have a nominal exercise price of $0.001 per share; (ii) be exercisable after the earlier of (A) the six-month anniversary after the date of issuance, (B) 120 days after the closing date of an Uplist Transaction, and (C) the date that a registration statement registering the Pre-Funded Warrant Shares is declared effective; (iii) be exercisable until all of the Pre-Funded Warrants are exercised in full; and (iv) have a provision preventing the exercisability of such Pre-Funded Warrants if, as a result of the exercise of the Pre-Funded Warrants, the holder, together with its affiliates and any other persons whose beneficial ownership of Company Common Stock would be aggregated with the holder’s, would be deemed to beneficially own more than either 4.99% or 9.99% of the Company’s Common Stock (the “Warrant Ownership Limitation”) immediately after giving effect to the exercise of the Pre-Funded Warrants. The holder, upon notice to the Company, may increase or decrease the Warrant Ownership Limitation; provided that (i) the Warrant Ownership Limitation may only be increased to a maximum of 9.99% of the Company’s Common Stock; and (ii) any increase in the Warrant Ownership Limitation will not become effective until the 61st day after delivery of such waiver notice. The number of shares of the Company’s Common Stock into which each of the Pre-Funded Warrants is exercisable and the exercise price therefor are subject to adjustment as set forth in the Pre-Funded Warrants, including adjustments for stock subdivisions or combinations (by any stock split, stock dividend, recapitalization, reorganization, scheme, arrangement or otherwise).

Common Warrants

The Common Warrants will (i) have an exercise price of $1.00 per share; (ii) have a term of exercise equal to 5 years after their issuance date; (iii) be exercisable after the earlier of (A) the six-month anniversary after the date of issuance and (B) the date that a registration statement registering the Common Warrant Shares is declared effective; (iv) have a provision permitting voluntary adjustments to the exercise price by the Company, subject to the prior written consent of the Common Warrant holder; (v) be automatically exchanged upon the closing of an Uplist Transaction for a new warrant (the “Exchange Warrant”) that is identical to the warrants (other than any pre-funded warrants), if any, being issued to investors in such Uplist Transaction, with the number of shares underlying such Exchange Warrant being equal to the number of Common Warrant Shares then underlying the Common Warrant multiplied by three and (vi) have a provision preventing the exercisability of such Common Warrants if, as a result of the exercise of the Common Warrants, the holder, together with its affiliates and any other persons whose beneficial ownership of Company Common Stock would be aggregated with the holder’s, would be deemed to beneficially own more than the Warrant Ownership Limitation immediately after giving effect to the exercise of the Common Warrants. The holder, upon notice to the Company, may increase or decrease the Warrant Ownership Limitation; provided that (i) the Warrant Ownership Limitation may only be increased to a maximum of 9.99% of the Company’s Common Stock; and (ii) any increase in the Warrant Ownership Limitation will not become effective until the 61st day after delivery of such waiver notice. The number of shares of the Company’s Common Stock into which each of the Common Warrants is exercisable and the exercise price therefor are subject to adjustment as set forth in the Common Warrants, including adjustments for stock subdivisions or combinations (by any stock split, stock dividend, recapitalization, reorganization, scheme, arrangement or otherwise).

Registration Rights Agreement

On the Closing Date, the Company entered into a registration rights agreement with the Investors (the “Registration Rights Agreement”), pursuant to which the Company is obligated, subject to certain conditions, to file with the Securities and Exchange Commission within the earlier of (i) 30 days following the closing date of the Uplist Transaction and (ii) 60 days after the Closing Date one or more registration statements (any such registration statement, a “Resale Registration Statement”) to register the Shares, the Warrant Shares, the shares of Common Stock issuable upon exercise in full of the Exchange Warrants (the “Exchange Warrant Shares”) and the shares of Common Stock issuable upon exercise in full of the Participating Pre-Funded Warrant (as defined below) (the “Conversion Warrant Shares”) for resale under the Securities Act of 1933, as amended (the “Securities Act”). The Company’s failure to satisfy certain filing and effectiveness deadlines with respect to a Resale Registration Statement and certain other requirements set forth in the Registration Rights Agreement may subject the Company to payment of monetary penalties.

The preceding descriptions of the SPA, Pre-Funded Warrants, Common Warrants, and Registration Rights Agreement are qualified in their entirety by reference to the copies of the form of Securities Purchase Agreement, form of Pre-Funded Warrant, form of Common Warrant, and form of Registration Rights Agreement, which the Company filed as exhibits 10.24, 4.1, 4.2, and 10.25, respectively, to its Quarterly Report on Form 10-Q for the three months ending June 30, 2023.

Note Modification Agreements

On July 7, 2023, the Company entered into an amendment (“Amendment No. 8 to the First Notes”) with the holders of the Company’s outstanding Senior Secured Convertible Promissory Notes, as amended on February 14, 2023, and as subsequently amended on March 10, 2023, March 15, 2023, April 15, 2023, May 15, 2023, June 15, 2023, and July 1, 2023, (as amended, the “First Notes”), issued in connection with a private placement financing the Company completed on July 6, 2022 (the “First Closing”). On July 1, 2023, the Company also entered into an amendment (“Amendment No. 8 to the Second Notes”) with the holders of the Company’s outstanding Unsecured Convertible Promissory Notes, as amended on February 14, 2023, and as subsequently amended on March 10, 2023, March 15, 2023, April 15, 2023, May 15, 2023, June 15, 2023, and July 1, 2023, (as amended, the “Second Notes”), issued in connection with a private placement financing the Company completed on January 18, 2023 (the “Second Closing”). On July 1, 2023, the Company also entered into an amendment (“Amendment No. 3 to the Third Notes” and, together with Amendment No. 8 to the First Notes and Amendment No. 8 to the Second Notes, the “Amendments to the 2022 Notes”) with the holders of the Company’s outstanding Unsecured Convertible Promissory Notes, as amended on June 15, 2023, and as subsequently amended on July 1, 2023 (as amended, the “Third Notes” and, together with the First Notes and Second Notes, the “2022 Notes”), issued in connection with a private placement financing the Company completed on May 15, 2023 (the “Third Closing”).

Under the Amendments to the 2022 Notes, the following amendments to the 2022 Notes will be simultaneously effective upon the closing of an Uplist Transaction. The Specified Percentage (as defined below) of the then outstanding principal amount of the 2022 Notes shall automatically convert (the “Automatic Conversion”) into shares of Common Stock, with the conversion price for purposes of such Automatic Conversion being equal to the lower of (i) the per unit price at which any units (each unit being comprised of one share or share equivalent and accompanying warrants, if any) are sold in the Uplist Transaction or (ii) the price at which warrants issued in the Uplist Transaction are exercisable (but in no event increased above the conversion price in effect immediately prior to the pricing of the Uplist Transaction).

In addition, if the Holder (as defined below) (i) participates in the Uplist Transaction and in the Bridge Offering for a combined (taking into account the Holder’s aggregate investment in the Uplist Transaction and the Bridge Offering) amount equal to no less than fifty percent (50%) of the Holder’s original purchase price under the 2022 Notes and (ii) the Holder’s amount of participation in the Uplist Transaction is at least 4.3 times the Holder’s amount of participation in the Bridge Offering, then the Holder shall receive a pre-funded warrant (the “Participating Pre-Funded Warrant”) to purchase a number of shares of Common Stock equal to the Specified Number (as defined below) times the dollar amount under the 2022 Notes that was converted in the Automatic Conversion. The Participating Pre-Funded Warrant (i) shall have an exercise price of $0.001 per share, (ii) may be exercised on a cashless basis, (iii) shall be exercisable by the Holder at any time commencing on the 90th day after issuance, (iv) may be redeemed by the Company for cash at a redemption price of $0.82 per share underlying the Participating Pre-Funded Warrant with any such redemption made pro rata to all holders of the Participating Pre-Funded Warrants, (v) and shall contain a customary beneficial ownership limitation provision. Additionally, the holder of the Participating Pre-funded Warrants will agree that, until January 6, 2024, it shall not offer, sell, assign, transfer, pledge, contract to sell, or otherwise dispose of, or announce the intention to otherwise dispose of, the Participating Pre-Funded Warrant.

“Specified Percentage” means the greater of: (i) the percentage specified by the Company by notice to the 2022 Note holders (the “Holders” and each a “Holder”) at least five business days prior to the closing of the Uplist Transaction, which percentage shall be the percentage necessary to ensure the applicable Nasdaq requirements regarding the Uplist Transaction are satisfied, and (ii) the percentage specified by the Holder by notice to the Company at least three business days prior to the closing of the Uplist Transaction (which percentage may be different for each 2022 Note as determined by each Holder thereof); provided, that in no event shall the Specified Percentage for the 2022 Notes (A) exceed twenty five percent (25%) unless otherwise agreed in writing by the Holder, or (B) exceed fifty percent (50%) unless otherwise agreed in writing by the Company.

“Specified Number” means, if the Specified Percentage is 50%, 2.4, which number shall be increased by 1.6% for each percentage point decrease in the Specified Percentage, such increase being compounded iteratively for each percentage point decrease in the Specified Percentage, with the result rounded to two decimal places.

Additionally, on July 7, 2023, the Company entered into an amendment (the “Omnibus Amendment to Notes and Warrants”) with the Holders of the 2022 Notes amending the 2022 Notes and related warrants issued at each of the First Closing, Second Closing, and Third Closing (the “First Warrants”, “Second Warrants” and “Third Warrants”, respectively, and collectively, the “2022 Warrants”). Under the Omnibus Amendment to Notes and Warrants, the 2022 Notes and 2022 Warrants were amended (i) to modify the Most Favored Nation provisions therein to exclude the Bridge Offering and (ii) to prohibit the Company from engaging in any capital raising transactions, subject to certain exceptions, until the earlier of (A) July 7, 2027, and (B) the first date on which all Holders hold less than 20% of the original amount of the Participating Pre-Funded Warrants received by each Holder, respectively, in connection with the Automatic Conversion.

The foregoing descriptions of Amendment No. 8 to the First Notes, Amendment No. 8 to the Second Notes, Amendment No. 3 to the Third Notes, and the Omnibus Amendment to Notes and Warrants do not purport to be complete and are qualified in their entirety by the full text of the Form of Amendment No. 8 to the First Notes, the Form of Amendment No. 8 to the Second Notes, the Form of Amendment No. 3 to the Third Notes, and the Form of Omnibus Amendment to Notes and Warrants which the Company filed as exhibits 10.17, 10.18, 10.19, 10.20, respectively, to its Quarterly Report on Form 10-Q for the three months ending June 30, 2023.

This Information Statement does not constitute an offer to sell or the solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities in any state or other jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction.

Effect on Outstanding Common Stock

The Authorized Share Increase will revise the total number of shares of Common Stock that we are authorized to issue from 12,000,000 to 350,000,000 shares of Common Stock. The Authorized Share Increase would not have any effect on the rights of existing stockholders and the par value per share of Common Stock will remain $0.001.

The Authorized Share Increase results in an effectively greater number of shares of authorized but unissued Common Stock being available for future issuance for various purposes, including raising capital or making acquisitions. We currently expect that the amount of authorized but unissued shares of Common Stock available for future issuances following the effective increase in authorized shares of Common Stock will be sufficient for our future needs.

Effective Time of the Effective Increase of Authorized Shares

The Authorized Share Increase would become effective, if at all, when the Authorized Share Charter Amendment is accepted and recorded by the office of the Secretary of State of the State of Nevada.

Anti-Takeover Effects

Although the Authorized Share Increase is not motivated by anti-takeover concerns and is not considered by our Board to be an anti-takeover measure, the availability of additional authorized shares of Common Stock could enable the Board to issue shares defensively in response to a takeover attempt or to make an attempt to gain control of the Company more difficult or time-consuming. For example, shares of Common Stock could be issued to purchasers who might side with management in opposing a takeover bid that the Board determines is not in our best interests, thus diluting the ownership and voting rights of the person seeking to obtain control of the Company. In certain circumstances, the issuance of Common Stock without further action by the stockholders may have the effect of delaying or preventing a change in control of the Company, may discourage bids for our Common Stock at a premium over the prevailing market price and may adversely affect the market price of our Common Stock. As a result, increasing the authorized number of shares of our Common Stock could render a hostile takeover, tender offer or proxy contest, assumption of control by a holder of a large block of our stock, and the possible removal of our incumbent management more difficult and less likely. We are not aware of any proposed attempt to take over the Company or of any present attempt to acquire a large block of our Common Stock.

ITEM 2 - THE GRANTING OF DISCRETIONARY AUTHORITY TO THE BOARD, AT ANY TIME FOR A PERIOD OF 12 MONTHS AFTER THE DATE OF THE WRITTEN CONSENT, TO AUTHORIZE THE ADOPTION OF AN AMENDMENT TO THE COMPANY’S CHARTER, TO EFFECT A REVERSE STOCK SPLIT OF THE ISSUED AND OUTSTANDING COMMON STOCK AT A RATIO BETWEEN 1.5 FOR 1 TO 20 FOR 1 WITHOUT CORRESPONDINGLY DECREASING THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK, SUCH RATIO TO BE DETERMINED BY THE BOARD, OR TO DETERMINE NOT TO PROCEED WITH THE REVERSE STOCK SPLIT

General

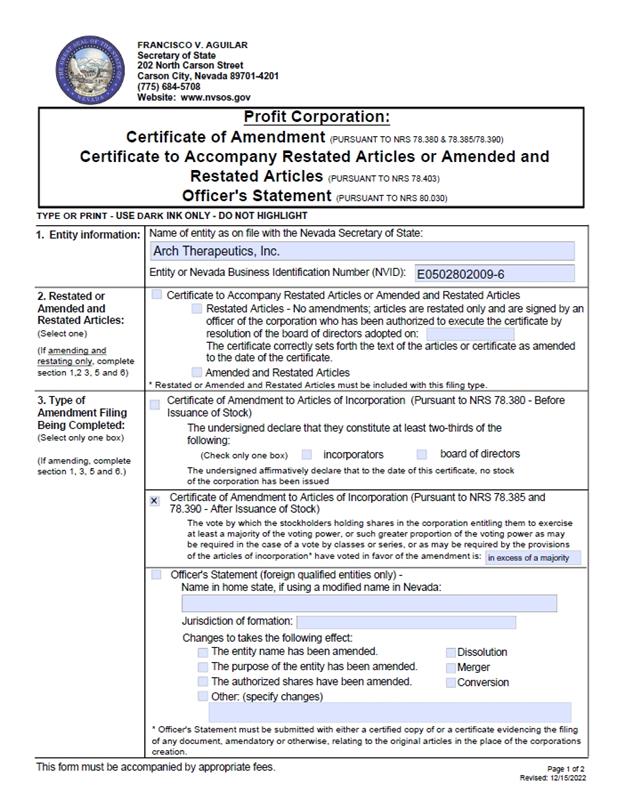

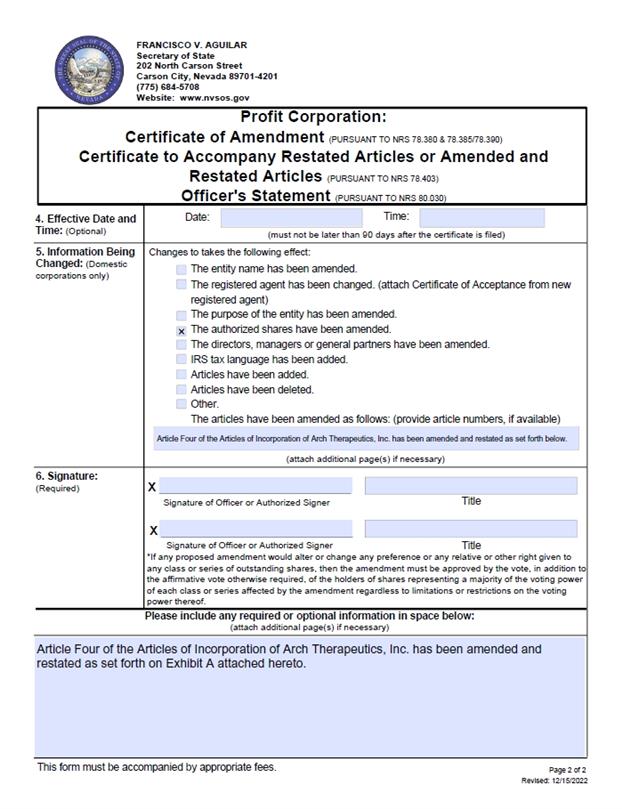

The Board and Majority Stockholders, pursuant to the Written Consent, approved a resolution to authorize the adoption of an amendment to the Articles of Incorporation to effect a reverse stock split of the issued and outstanding Common Stock at any time on or prior to August 22, 2024, at a ratio between 1.5:1 to 20:1 without correspondingly decreasing the number of authorized shares of Common Stock, such ratio to be determined by the Board (the “Reverse Stock Split”). The Reverse Stock Split will be effected by an amendment to our Charter included in Exhibit B to this Information Statement that, once filed with the Office of the Secretary of State of Nevada, will combine between one point five (1.5) and twenty (20) shares of our Common Stock into one share of Common Stock (the “Reverse Stock Split Amendment”). The Board reserves the right to elect to abandon the Reverse Split if it determines, in its sole discretion, that the Reverse Split is no longer in the best interests of the Company and our stockholders.

No fractional shares will be issued in connection with the Reverse Split. We will round up any fractional shares resulting from the Reverse Split to the nearest whole share. We will aggregate all shares held by a stockholder prior to implementing fractional share rounding, and issue a full share of post-Reverse Split Common Stock to any stockholder who would otherwise have been entitled to receive a fractional share of Common Stock as a result of the Reverse Split.

When implemented, the Reverse Split will not change the par value of our Common Stock. Except to the extent the Reverse Split would result in fractional shares, as described above, each stockholder will hold the same percentage of Common Stock outstanding immediately following the Reverse Split as such stockholder held immediately prior to the Reverse Split.

Purpose and Background of the Reverse Stock Split

Our primary objective in the Reverse Split is to attempt to raise the per share trading price of our Common Stock in order to gain a listing on the NASDAQ or NYSE MKT exchange (in either case, an “Exchange”). Before our Common Stock may be listed on an Exchange, we must satisfy certain listing requirements. One of these listing requirements is that our Common Stock must have a minimum bid price of $4.00 per share. Our Common Stock is currently traded on the QB tier of the OTC Marketplace (“OTCQB”) under the symbol “ARTH.” On the Record Date, the closing sale price of a share of our Common Stock on the OTCQB was $2.96.

We anticipate that the Reverse Split will increase the per share bid price per share of our Common Stock above $4.00, and thereby satisfy one of the Exchange’s listing requirements. However, we cannot be certain that the Reverse Split will, initially or in the future, have the intended effect of raising the bid price of our Common Stock above $4.00 per share.

In addition to our desire to be listed on an Exchange, the Board believes that the low market price of our Common Stock impairs our marketability and acceptance by institutional investors and other members of the investing public and creates a negative impression of the Company. Theoretically, decreasing the number of shares of Common Stock outstanding should not, by itself, affect the marketability of the shares, the type of investor who would be interested in acquiring them, or our reputation in the financial community. In practice, however, many investors and market makers consider low-priced stocks as unduly speculative in nature and, as a matter of policy, avoid investment and trading in such stocks. The presence of these negative perceptions may adversely affect not only the pricing of our Common Stock but also the trading liquidity. In addition, these perceptions may affect our commercial business and our ability to raise additional capital through equity and debt financings.

We expect that the anticipated increase in the per share trading price resulting from the Reverse Split will encourage greater interest in our Common Stock among members of the financial community and the investing public and possibly create a more liquid market for our stockholders. However, the possibility exists that stockholder liquidity may be adversely affected if the Reverse Split is effected, particularly if the price per share of our Common Stock begins a declining trend after the Reverse Split takes effect.

Certain Risk Factors Associated with the Reverse Split

Reduced Market Capitalization. As noted above, the principal purpose of the Reverse Split, if implemented, will be to raise the price of our Common Stock to obtain a listing on an Exchange. We cannot assure you, however, that the Reverse Split will accomplish this objective. While we expect that the reduction in our outstanding shares of Common Stock will increase the market price of our Common Stock, we cannot assure you that the Reverse Split will increase the market price of our Common Stock by a multiple equal to the number of pre-Reverse Split shares in the Reverse Split ratio determined by the Board, or result in any permanent increase in the market price, which can be dependent upon many factors, including our business and financial performance and prospects. Should the market price decline after implementation of the Reverse Split, the percentage decline may be greater, due to the smaller number of shares outstanding, than it would have been prior to the Reverse Split. In some cases, the share price of companies that have implemented reverse stock splits has subsequently declined back to pre-reverse split levels. Accordingly, we cannot assure you that the market price of our Common Stock immediately after the Reverse Split takes effect will be maintained for any period of time or that the ratio of post and pre-split shares will remain the same after the Reverse Split is effected, or that the Reverse Split will not have an adverse effect on our stock price due to the reduced number of shares immediately outstanding after the Reverse Split and prior to the Authorized Share Increase. A reverse stock split is often viewed negatively by the market and, consequently, can lead to a decrease in our overall market capitalization. If the per share price does not increase proportionately as a result of the Reverse Split, then our overall market capitalization will be reduced.

Increased Transaction Costs. The number of shares held by each individual stockholder will be reduced if the Reverse Split is implemented. This will increase the number of stockholders who hold less than a “round lot,” or 100 shares. Typically, the transaction costs to stockholders selling “odd lots” are higher on a per share basis. Consequently, the Reverse Split could increase the transaction costs to existing stockholders in the event they wish to sell all or a portion of their position.

Liquidity. Although the Board believes that the decrease in the number of shares of our Common Stock outstanding as a consequence of the Reverse Split and the anticipated increase in the price of our Common Stock could encourage interest in our Common Stock and possibly promote greater liquidity for our stockholders, such liquidity could also be adversely affected by the reduced number of shares outstanding after the Reverse Split.

No Appraisal Rights

Under the Nevada General Corporation Law, our stockholders are not entitled to appraisal rights with respect to the Reverse Split, and the Company is not independently providing and has not so provided stockholders with any such right.

Determination of the Ratio for the Reverse Stock Split

The ratio of the Reverse Split will be determined by the Board, in its sole discretion. However, the ratio will not be less than a ratio of one point five-for-one (1.5:1) or exceed a ratio of twenty-for-one (20:1). In determining the Reverse Split ratio, the Board will consider numerous factors, including the historical and projected performance of our Common Stock, prevailing market conditions and general economic trends, and will place emphasis on the expected closing price of our Common Stock in the period following the effectiveness of the Reverse Split. The Board will also consider the impact of the Reverse Split ratio on investor interest. The purpose of selecting a range is to give the Board the flexibility to meet business needs as they arise, to take advantage of favorable opportunities and to respond to a changing corporate environment. Based on the number of shares of Common Stock issued and outstanding as of the Record Date, immediately following the completion of the Reverse Split, and before implementation of the Authorized Share Increase, we will have approximately between 2,022,972 and 151,722 shares of Common Stock issued and outstanding, depending on the ratio of the Reverse Split determined by the Board.

Principal Effects of the Reverse Stock Split

The Reverse Split will affect all of our stockholders uniformly and will not change the proportionate equity interests of our stockholders, nor will the respective voting rights and other rights of stockholders be altered, except for possible changes due to the treatment of fractional shares resulting from the Reverse Split. As described above, we will round up any fractional shares resulting from the Reverse Split to the nearest whole share.

Common Stock issued and outstanding pursuant to the Reverse Split will remain fully paid and non-assessable. The authorization for the Board to implement the Reverse Split is not being proposed in response to any effort, of which we are aware, to accumulate shares of Common Stock or obtain control of the Company, nor is it part of a plan by management to recommend to the Board and stockholders a series of amendments to our Articles of Incorporation.

We do not anticipate a material decrease in the number of holders of record of our Common Stock after the Board implements the Reverse Split, including in the event the ratio of the Reverse Split determined by the Board is twenty-for-one (20:1).

Effect on Outstanding Derivative Securities

The Reverse Split will require that proportionate adjustments be made to the conversion rate, the per share exercise price and the number of shares issuable upon the vesting, exercise or conversion of the outstanding derivative securities issued by us, in accordance with the Reverse Split Ratio. The adjustments to such securities, as required by the Reverse Split and in accordance with the Reverse Split Ratio, would result in approximately the same aggregate price being required to be paid under such securities upon exercise, and approximately the same value of shares of Common Stock being delivered upon such exercise or conversion, immediately following the Reverse Split as was the case immediately preceding the Reverse Split.

Effect on Stock Option Plans

Our Amended and Restated 2023 Equity Incentive Plan (the “2023 Plan,” or the “Plan”) is designed primarily to provide stock-based incentives to employees. After the Reverse Split, the Board shall make appropriate adjustments to awards granted under the 2023 Plan or our 2013 Stock Incentive Plan (the “2013 Plan”). Accordingly, after the Reverse Split, as of the effective date the number of all outstanding option grants, the number of shares issuable and the exercise price, as applicable, relating to options under our 2023 Plan and 2013 Plan, will be proportionately adjusted according to the Reverse Split ratio. The Board has also authorized us to effect any other changes necessary, desirable or appropriate to give effect to the Reverse Split, including any applicable technical, conforming changes.

The terms of our outstanding stock options do not permit exercise for fractional shares. As such, the number of shares issuable under any individual outstanding stock option shall either be rounded up or down as provided for under the specific terms of our 2023 Plan and 2013 Plan. Commensurately, the exercise price under each stock option would be increased proportionately such that upon exercise, the aggregate exercise price payable by the optionee to us would remain the same.

Effective Date; Exchange Act Registration Status

The proposed Reverse Split of our Common Stock may be implemented by the Board at any time prior to August 22, 2024. The Reverse Split will become effective as of 4:01 p.m., Eastern Time (the “Effective Date”), on the date of filing the Reverse Stock Split Amendment with the office of the Secretary of State of Nevada. Except as explained below with respect to fractional shares, on the Effective Date, shares of our Common Stock issued and outstanding immediately prior thereto will be combined, automatically and without any action on the part of the stockholders, into one share of Common Stock in accordance with the Reverse Split ratio determined by the Board. After the Effective Date, the Common Stock will have a new committee on uniform securities identification procedures (“CUSIP”) number, which is a number used to identify our equity securities, and stock certificates with the old CUSIP number must be exchanged for stock certificates with the new CUSIP number by following the procedures described below. After the Effective Date, we will continue to be subject to periodic reporting and other requirements of the Exchange Act and our Common Stock will continue to be traded on the OTCQB. Promptly following the execution of the Reverse Split, however, we intend to apply to list our shares of Common Stock on an Exchange.

Exchange of Stock Certificates and Elimination of Fractional Share Interests

We will appoint Empire Stock Transfer to act as exchange agent for holders of our Common Stock in connection with the Reverse Split. As of July 18, 2023, we have approximately 107 holders of record of our Common Stock (although we have significantly more beneficial holders). We do not expect the Reverse Split to result in a reduction in the number of record holders. We presently do not intend to seek any change in our status as a reporting company for federal securities law purposes, either before or after the Reverse Split.

Fractional shares with respect to our Common Stock will not be issued in connection with the Reverse Split. We will round up any fractional shares of our Common Stock resulting from the Reverse Stock Split to the nearest whole share.

On or after the Effective Date, we will mail a letter of transmittal to each of our stockholders. Each stockholder will then be able to obtain a certificate evidencing its post-Reverse Split shares of Common Stock, together with the properly executed and completed letter of transmittal and such other evidence of ownership of the shares as we may require. Our stockholders will not receive certificates for post-Reverse Split shares unless and until their old certificates are surrendered. Stockholders should not forward their certificates to the exchange agent until they receive the letter of transmittal, and they should only send in their certificates with the letter of transmittal. The exchange agent will send each stockholder’s new stock certificate promptly after receipt of that stockholder’s properly completed letter of transmittal and old stock certificate(s).

Stockholders will not be required to pay any service charges in connection with the exchange of old certificates.

Effect on Registered and Beneficial Stockholders

Upon the Effective Date, we intend to treat stockholders holding shares of Common Stock in “street name,” through a bank, broker or other nominee, in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers or other nominees will be instructed to affect the Reverse Split for their beneficial holders of Common Stock in “street name.” However, these banks, brokers or other nominees may apply their own specific procedures for processing the Reverse Split. If you hold your shares with a bank, broker or other nominee, and if you have any questions in this regard, we encourage you to contact your nominee.

STOCKHOLDERS SHOULD NOT DESTROY ANY PRE-SPLIT STOCK CERTIFICATES AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Procedures for Implementing the Reverse Split

The Reverse Stock Split will be implemented by filing the Reverse Stock Split Amendment to the Charter with the Secretary of State of Nevada. The Reverse Split will become effective as set forth in the section captioned “Effective Date; Exchange Act Registration Status” above. As of the Effective Date, each certificate representing shares of our Common Stock before the Reverse Split would be deemed, for all corporate purposes, to evidence ownership of the reduced number of shares of our Common Stock resulting from the Reverse Split. However, a holder of any unexchanged certificates will not be entitled to receive any dividends or other distributions payable by us after the Effective Date until the old certificates are surrendered. Subject to the various escheat laws, such dividends and distributions, if any, would be accumulated, and at the time of surrender of the old certificates, all such unpaid dividends or distributions will be paid without interest. All shares underlying options, warrants, convertible notes and other securities will also be automatically adjusted on the Effective Date. Our transfer agent, Empire Stock Transfer, will act as the exchange agent for the purposes of implementing the exchange of stock certificates. As soon as practicable after the Effective Date, stockholders and holders of stock options exercisable for our Common Stock will be notified of the effectiveness of the Reverse Split. Stockholders of record will receive a letter of transmittal requesting them to surrender their old stock certificates for new stock certificates, bearing the new CUSIP number and reflecting the adjusted number of shares as a result of the Reverse Split. Persons who hold their shares in brokerage accounts or “street name” will not be required to take any further action to effect the exchange of their shares. No new certificates will be issued to a stockholder until surrender of any outstanding certificates together, with the properly completed and executed letter of transmittal to the exchange agent. Until surrender, each certificate representing pre-Reverse Split share will continue to be valid and will represent the adjusted number of shares based on the ratio of the Reverse Split. Stockholders should not destroy any stock certificate and should not submit any certificates until they receive a letter of transmittal.

Reservation of Right to Abandon the Reverse Split

We reserve the right to abandon the Reverse Split without further action by our stockholders at any time before the Effective Date of the Reverse Stock Split Amendment.

Accounting Matters

The Reverse Split will not change total stockholders’ equity on our balance sheet. However, because the par value of our Common Stock will remain unchanged on the Effective Date, the components that make up total stockholders’ equity will change by offsetting amounts. Depending on the ratio of the Reverse Split, as determined by the Board, our stated capital component will be reduced to an amount between sixty-seven hundredths (1/1.5) and five hundredths (1/20) of its present amount, and our additional paid-in capital component will be increased with the amount by which the stated capital is reduced. The per share net income or loss and net book value of our Common Stock will be increased because there will be fewer shares of our Common Stock outstanding. In addition, our historical amounts of net income or loss per share of Common Stock previously reported by us, as well as all references to Common Stock share amounts, will be restated to reflect the Reverse Split as if it had been in effect as of the earliest reported period.

Federal Income Tax Consequences of the Reverse Split

The following summary of certain material United States federal income tax consequences of the Reverse Split does not purport to be a complete discussion of all of the possible federal income tax consequences of the Reverse Split and is included for general information only. Furthermore, it does not address any state, local or foreign income or other tax consequences. Also, it does not address the tax consequences to holders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, foreign entities, nonresident alien individuals, broker-dealers and tax-exempt entities. The discussion is based on the provisions of the United States federal income tax law as of the date hereof, which is subject to change retroactively as well as prospectively. This summary also assumes that the pre-Reverse Split shares were, and the post-Reverse Split shares will be, held as a “capital asset,” as defined in the Internal Revenue Code (i.e. generally, property held for investment). The tax treatment of any stockholder may vary depending upon the particular circumstances of such stockholder. Each stockholder is urged to consult with such stockholder’s own tax advisor with respect to the tax consequences of the Reverse Split.

Tax Consequences to the Company. We do not expect to recognize any gain or loss as a result of the proposed Reverse Split.

Tax Consequences to Stockholders. No gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-Reverse Split shares for post-Reverse Split shares pursuant to the Reverse Split. As noted above, we will not issue fractional shares of our Common Stock in connection with the Reverse Stock Split. Instead, we will issue one full share of post‑Reverse Stock Split Common Stock to any stockholder who would have been entitled to receive a fractional share of Common Stock as a result of the Reverse Stock Split. The U.S. federal income tax consequences of the receipt of such an additional share of our Common Stock are not clear. The tax treatment of a stockholder may vary depending upon the particular facts and circumstances of such stockholder. Accordingly, each U.S. holder should consult with his or her own tax advisor with respect to all of the potential tax consequences to him or her of the Reverse Stock Split.

ITEM 3 - AUTHORIZATION TO AMEND THE COMPANY’S ARTICLES OF INCORPORATION TO AUTHORIZE PREFERRED SHARES OF FIVE MILLION (5,000,000), $0.001 PAR VALUE PER SHARE, IN SUCH CLASSES OR SERIES WITH SUCH RIGHTS, PRIVILEGES AND PREFERENCES AS THE BOARD MAY HEREAFTER DETERMINE IN ITS SOLE DISCRETION

Our Board and the Majority Stockholders, pursuant to the Written Consent, have consented to authorize 5,000,000 shares of preferred stock (“Preferred Stock”) by filing an amendment to our Charter (the “Blank Check Amendment”). These are known as “blank check” Preferred Stock because the Board can set in its discretion the classes, series and rights, privileges and preferences as it may determine in the future, in its sole discretion in the exercise of its business judgment. The text of the proposed amendment to the Company’s Charter to effect the Blank Check Amendment is included in Exhibit C to this Information Statement (the “Blank Check Charter Amendment”). The Company will have the authority to file the Blank Check Charter Amendment with the Secretary of State of the State of Nevada, which will become effective upon its filing; provided, however, that the Blank Check Charter Amendment is subject to revision to include such changes as may be required by the office of the Secretary of State of the State of Nevada and as the Board deems necessary and advisable.

Reasons for the Preferred Stock Authorization

The Board believes that it is in the Company’s and stockholders’ best interest to authorize shares of Preferred Stock to meet business needs as they arise without the expense or delay of a special meeting of stockholders to approve additional authorized shares at that time. Such business needs may include future offerings of preferred stock, future issuances of preferred stock in connection with the acquisition of other companies or assets, and other proper corporate purposes identified by the Board in the future. Any future issuance of Preferred Stock of the Company would remain subject to separate stockholder approval if required by applicable law, the Company’s articles of incorporation (as amended), or the rules of any national securities exchange on which shares of Preferred Stock of the Company are then listed.

Anti-Takeover Effects

The authorized but unissued shares of Preferred Stock could have anti-takeover effects. Under certain circumstances, any or all of the Preferred Stock could be used as a method of discouraging, delaying or preventing a change in control of the Company. For example, the Board could designate and issue a series of Preferred Stock in an amount that sufficiently increases the number of outstanding shares to overcome a vote by the holders of Common Stock or with rights and preferences that include special voting rights to veto a change in control. The Preferred Stock could also be used in connection with the issuance of a stockholder rights plan, sometimes referred to as a “poison pill.”

Use of the Preferred Stock in the foregoing manner could delay or frustrate a merger, tender offer or proxy contest, the removal of incumbent directors, or the assumption of control by stockholders, even if such proposed actions would be beneficial to the Company’s stockholders. This could include discouraging bids for the Company even if such bid represents a premium over the Company’s then-existing trading price and thereby prevent stockholders from receiving the maximum value for their shares.

Other Potential Effects of the Proposed Amendment

The authorization of the Blank Check Charter Amendment will not, by itself, have any effect on the rights of present stockholders. The shares of Preferred Stock to be authorized will be “blank check” serial preferred stock. This type of preferred stock allows the Board to issue one or more series of the Preferred Stock, from time to time, with full, limited or no voting powers, and to fix all of the designations, preferences and relative, participating, optional or special voting rights, and qualifications, limitations or other restrictions upon the Preferred Stock.

Management also will have the discretion, subject to the approval of the Board how, when, and for what consideration the Preferred Stock may be issued. The Board can approve significant liquidation, dividend, voting conversion, and redemption rights that are very superior to those of Common Stock to the serious detriment of common stockholders.

Under the Charter, the Company’s stockholders do not have preemptive rights to subscribe for additional shares of capital stock which may be issued by the Company, which means that current stockholders do not have a prior right to purchase any new issue of capital stock of the Company in order to maintain their proportionate ownership of such shares. In addition, if the Board elects to issue additional shares of Preferred Stock, such issuance could have a dilutive effect on the earnings per share, voting power and holdings of current holders of Common Stock or Preferred Stock.

Exchange Act Matters

Our Common Stock is currently registered under the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Split, if implemented, will not affect the registration of our Common Stock under the Exchange Act or our reporting or other requirements thereunder. Our Common Stock is currently traded on the OTCQB under the symbol “ARTH”, subject to our continued satisfaction of the OTCQB market listing requirements.

ITEM 4 - ADOPTION OF THE AMENDED AND RESTATED 2023 EQUITY INCENTIVE PLAN

Our Board and management believe that the effective use of stock-based long-term incentive compensation is vital to our ability to achieve strong performance in the future. The 2023 Equity Incentive Plan was initially adopted by the Board on July 18, 2023, and amended and restated by the Board on August 13, 2023, subject to ratification by stockholders. On August 22, 2023, pursuant to the Written Consent, the Majority Stockholders ratified the Amended and Restated 2023 Equity Incentive Plan (the “2023 Plan”) in the form of the attached Exhibit D.

Summary of the 2023 Plan

The following is a summary of the material features of the 2023 Plan and is qualified in its entirety by reference to the full text of the 2023 Plan, which is attached as Exhibit D to this Information Statement. Capitalized terms used in this summary and not otherwise defined shall have the meaning set forth in the 2023 Plan.

Overview

The general purpose of the 2023 Plan is to provide a means whereby eligible employees, officers, non-employee directors and other individual service providers may develop a sense of proprietorship and personal involvement in our development and financial success, and to encourage them to devote their best efforts to us, thereby advancing our interests and the interests of stockholders. The 2023 Plan will allow us to grant stock options, restricted stock awards, unrestricted stock awards and similar kinds of equity-based compensation. Since our 2013 Stock Incentive Plan expired on June 18, 2023, the 2023 Plan will serve as the only plan pursuant to which we can grant stock options and other equity-based awards to incentivize our eligible employees, officers, non-employee directors and other individual service providers.

Shares Subject to the 2023 Plan

The 2023 Plan reserves an aggregate of 455,169 shares of our Common Stock for the issuance of awards under the 2023 Plan (the “Share Limit”), representing 15% of our shares of Common Stock outstanding on a fully-diluted basis as of the date of this proposal. Pursuant to the 2023 Plan’s “evergreen” provision, the Share Limit shall be cumulatively increased (i) each October 1, commencing October 1, 2023, by 5% of the number of shares of Common Stock issued and outstanding on the immediately preceding September 30 (such cumulative shares being the “Evergreen Shares”). In addition, effective at the close of business on the date of the closing (the “Uplist Date”) of the public offering in connection with which our Common Stock becomes tradeable on a national exchange and on the first day of each fiscal quarter of the Company thereafter until the earlier of (i) the five-year anniversary of the Uplist Date and (ii) October 31, 2028, the Share Limit will automatically increase by an amount equal to fifteen percent (15%) of the incremental number of shares of our Common Stock, if any, issued (x) with respect to the “Bridge Offering” (including without limitation “Pre-Funded Warrant Shares” and “Common Warrant Shares”), the “Uplist Transaction” and/or a “Qualifying Offering” (as such terms are used in the Company’s current report on Form 8-K filed with the Securities Exchange Commission on July 13, 2023), (y) with respect to the Uplist Date, since the date on which the stockholders ratified the 2023 Plan, and (z) with respect to each fiscal quarter thereafter, during the previous fiscal quarter (excluding in each case shares of Common Stock issued pursuant to awards under the 2023 Plan); provided, however, that shares of Common Stock issued in connection with any such Qualifying Offering shall not be taken into account except to the extent, if any, that such shares are issued with respect to shares of Common Stock issued in connection with the Bridge Offering and/or the Uplist Transaction (the cumulative number of all such incremental shares of Common Stock being referred to as “Capital Raise Shares”). The Board may, however, act prior to the Uplist Date or the first day of any such fiscal year or fiscal quarter, as applicable, to provide that there will be no increase in the Share Limit upon the Uplist Date or for the fiscal year or fiscal quarter, as applicable, or that the increase in the Share Limit for the Uplist Date or the fiscal year or fiscal quarter, as applicable, will be a lesser number of shares of Common Stock than would otherwise occur.