UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Arch Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | ||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| ¨ | Fee paid previously with preliminary materials. | ||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

ARCH THERAPEUTICS, INC.

235 Walnut Street, Suite 6

Framingham, MA 01702

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

JULY 1, 2020

To the Stockholders of Arch Therapeutics, Inc. (the “Company”):

NOTICE IS HEREBY GIVEN that a special meeting of the Company (the “Special Meeting”) will be held on July 1, 2020 at 10:00 a.m. eastern time. Due to concerns regarding the coronavirus outbreak (“COVID-19”) and to assist in protecting the health and well-being of our stockholders and employees, the Special Meeting will be held live via the internet. In order to attend the Special Meeting, you must register at http://viewproxy.com/arth/2020. We are holding the Special Meeting to:

| 1. | Increase the number of authorized shares of our common stock, par value $0.001 per share (“Common Stock”), from 300,000,000 to 800,000,000 shares (“Proposal 1” or the “Charter Amendment Proposal”). |

Only stockholders of record at the close of business on May 26, 2020 are entitled to receive notice of and to vote at the Special Meeting or any postponement or adjournment thereof. The Company’s board of directors recommends that you vote “FOR” Proposal 1 set forth above.

Your vote is important. Whether you plan to attend the Special Meeting live via the internet or not, you may vote your shares over the internet, by calling toll-free at the telephone number indicated on the enclosed proxy card, or by marking, signing, dating and mailing the proxy card in the envelope provided. If you attend the Special Meeting live via the internet and prefer to vote during the Special Meeting, you may do so even if you have already voted your shares.

You will be able to attend the Special Meeting and vote your shares during the Special Meeting live via the internet. In order to participate in the Special Meeting live via the internet, you must register at http://viewproxy.com/arth/2020 by 11:59 PM eastern time on June 29, 2020 If you are a registered holder, you must register using the Control Number included on your proxy card. If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you will be assigned a Control Number in order to vote your shares during the Special Meeting. Instructions on how to connect and participate live via the internet, including how to demonstrate proof of stock ownership, are posted at http://viewproxy.com/arth/2020.

The Board of Directors is soliciting the accompanying proxy to vote at the Special Meeting. We sent copies of this Proxy Statement to holders of our Common Stock on or about June 5, 2020. Reference is made to the attached Proxy Statement for further information with respect to the business to be transacted at the Special Meeting.

Thank you for your ongoing support and continued interest in Arch Therapeutics, Inc. We look forward to seeing you at the Special Meeting.

By Order of the Board of Directors,

Terrence W. Norchi, MD

President and Chief Executive Officer

June 5, 2020 Framingham, Massachusetts

ii

TABLE OF CONTENTS

iii

ARCH THERAPEUTICS, INC.

INFORMATION ABOUT THE PROXY STATEMENT AND SPECIAL MEETING

SPECIAL MEETING OF STOCKHOLDERS

This proxy statement contains information related to the Special Meeting of Stockholders (the “Special Meeting”) of Arch Therapeutics, Inc., a Nevada corporation (“Arch” or the “Company”) to be held on July 1, 2020 at 10:00 a.m. eastern time, or at such other time and place to which the Special Meeting may be adjourned or postponed. Due to concerns regarding the coronavirus outbreak (“COVID-19”) and to assist in protecting the health and well-being of our stockholders and employees, the Special Meeting will be held live via the internet. In order to attend the Special Meeting, you must register at http://viewproxy.com/arth/2020. The enclosed proxy is solicited by the Board of Directors of the Company (the “Board”). The proxy materials relating to the Special Meeting are being mailed to stockholders entitled to vote at the meeting on or about June 5, 2020.

ABOUT THE MEETING

Why are we calling this Special Meeting?

We are calling the Special Meeting to seek the approval of our stockholders:

| • | To increase the total number of authorized shares of our common stock, par value $0.001 per share (“Common Stock”), from 300,000,000 to 800,000,000 shares (“Proposal 1” or the “Charter Amendment Proposal”). |

What are the Board’s recommendations?

Our Board believes that the Charter Amendment Proposal is advisable and in the best interests of the Company and its stockholders and recommends that you vote FOR the Charter Amendment Proposal.

Who is entitled to vote at the meeting?

Only stockholders of record at the close of business on the record date, May 26, 2020, are entitled to receive notice of the Special Meeting and to vote the shares of Common Stock that they held on that date at the meeting, or any postponement or adjournment of the meeting. Holders of our Common Stock are entitled to one vote per share on each matter to be voted upon.

As of the record date, we had 187,862,947 outstanding shares of Common Stock.

Under What Circumstances May the Special Meeting be Adjourned?

Under the Company’s Amended and Restated Bylaws (the “Bylaws”), a meeting of stockholders may be adjourned:

| · | by vote of the holders of a majority of the shares represented in person or by proxy at such meeting if there is a not a quorum; and |

| · | by the person presiding over any meeting of stockholders, which will generally be the Chairman of the Board of Directors. |

In addition, the Bylaws also authorize the Board of Directors to adopt by resolution such rules and regulations for the conduct of stockholder meetings as the Board of Directors shall deem appropriate. Pursuant to that authority, the Company’s officers have been authorized to adjourn the Special Meeting at any time up to and including the meeting date for up to thirty (30) days to enable the solicitation of additional proxies in favor of the adoption of the Charter Amendment Proposal.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the Special Meeting.

How do I attend and vote shares at the Special Meeting?

Both stockholders of record and stockholders who hold their shares in “street name” (as defined below) will need to register to be able to attend the Special Meeting, vote their shares during the Special Meeting live via the internet by following the instructions below.

-1-

If you are a shareholder of record, you must:

| · | Follow the instructions provided on your proxy card to first register at http://viewproxy.com/arth/2020 by 11:59 PM eastern time on June 29, 2020. You will need to enter your name, phone number, Control Number (included on your proxy card), and e-mail address as part of the registration, following which you will receive an e-mail confirming your registration, as well as the password to attend the Special Meeting. |

| · | On the day of the Special Meeting, if you have properly registered, you may enter the Special Meeting by clicking the “Join Webinar” button on the meeting invite that you received via e-mail along with the password provided in that e-mail (you will need the Control Number included on your proxy card if you wish to vote). |

| · | If you wish to vote your shares electronically at the Special Meeting, there will be a live link provided during the Special Meeting (you will need the Control Number included on your proxy card to vote). |

If your shares are held in a “street name,” you must:

| · | Obtain a legal proxy from your broker, bank, or other nominee. |

| · | Register at http://viewproxy.com/arth/2020 by 11:59 PM eastern time on June 29, 2020. As part of the registration process you will need to enter your name, phone number, and e-mail address, and provide a copy of the legal proxy (which may be uploaded to the registration website or sent via e-mail to virtualmeeting@viewproxy.com), following which you will receive an e-mail confirming your registration, your Control Number, as well as the password to attend the Special Meeting. |

On the day of the Special Meeting, if you have properly registered, you may enter the Special Meeting by logging in using the password you received via e-mail in your registration confirmation at http://viewproxy.com/arth/2020/vm/ (you will need the Control Number assigned to you in your registration confirmation e-mail).

| · | If you wish to vote your shares electronically at the Special Meeting, there will be a live link provided during the Special Meeting (you will need the Control Number assigned to you in your registration confirmation e-mail to vote). |

Further instructions on how to attend the Special Meeting live via the internet, including how to vote your shares electronically at the Special Meeting are posted on http://viewproxy.com/arth/2020. The Special Meeting will begin, live via the internet, promptly at July 1, 2020 at 10:00 a.m. eastern time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 9:30 a.m. eastern time, and you should allow ample time for the check-in procedures.

What if I have technical difficulties during the Special Meeting?

There will be technicians ready to assist you with any technical difficulties you may have accessing the Special Meeting live via the internet. Please be sure to check in by 9:30 a.m. eastern time on July 1, 2020, the day of the Special Meeting, so we may address any technical difficulties before the Special Meeting begins live via the internet. If you encounter any difficulties accessing the Special Meeting during the check-in or meeting time, please e-mail virtualmeeting@viewproxy.com or call 1-866-612-8937.

What constitutes a quorum?

The presence at the Special Meeting, in person or by proxy, of the holders of a majority of our Common Stock outstanding on the record date will constitute a quorum for our meeting. Signed proxies received but not voted and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

How do I vote?

| · | Before the Special Meeting: You can vote on matters that come before the Special Meeting by (i) completing, signing, dating and returning the enclosed proxy card in the accompanying prepaid envelope; (ii) calling toll-free at the telephone number indicated on the enclosed proxy card; or (iii) using the internet in accordance with the instructions set forth on the enclosed proxy card. |

If you are a stockholder of record, to submit your proxy by mail, by telephone or vote via the Internet, follow the instructions on the proxy card. If you hold your shares in street name, you may vote by mail, by telephone or via the Internet as instructed by your broker, bank or other nominee.

-2-

Your shares will be voted as you indicate on your proxy card. If you sign your proxy but you do not indicate your voting preferences, and with respect to any other matter that properly comes before the meeting, the individuals named on the proxy card will vote your shares in accordance with the recommendations of the Board, or if no recommendation is given, in their own discretion.

| · | During the Special Meeting: If you attend the Special Meeting live via the internet and prefer to vote during the Special Meeting, you may do so even if you have already voted your shares by proxy. If you wish to vote your shares electronically at the Special Meeting, there will be a live link provided during the Special Meeting. See above, “How do I attend and vote shares at the Special Meeting?.” |

Even if you plan to attend the Special Meeting live via the internet, we encourage you to vote in advance by internet, telephone or mail so that your vote will be counted if you later decide not to attend the Special Meeting live via the internet.

What if I vote and then change my mind?

If you are a stockholder of record, you may revoke your proxy at any time before it is exercised by:

| · | filing a notice of revocation with the Secretary of the Company; |

| · | sending in another duly executed proxy bearing a later date; or |

| · | attending the Special Meeting live via the internet and casting your vote by following the procedures described under the heading “How do I attend and vote shares at the Special Meeting?” above. |

For purposes of submitting your vote online before the Special Meeting, you may change your vote until 11:59 p.m. eastern time at www.AALvote/com/ARTH on June 30, 2020. At this this deadline, the last vote submitted will be the vote that is counted.

If you hold shares of Common Stock through a stockbroker, bank or other nominee rather than directly (that is, in “street name”), please follow their directions on how to revoke previously submitted instructions relating to your shares.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many of our stockholders hold their shares of Common Stock in street name. As summarized below, there are some distinctions between shares held of record and those owned beneficially

Stockholder of Record

If your shares of Common Stock are registered directly in your name with our transfer agent, Empire Stock Transfer, you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Special Meeting.

Beneficial Owner

If your shares of Common Stock are held in street name, you are considered the beneficial owner of such shares, and these proxy materials are being forwarded to you by your broker, bank or nominee which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker as to how to vote. However, because you are not the stockholder of record, you may not attend the Special Meeting and vote these shares in person at the Special Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. If you do not vote your shares or otherwise provide the stockholder of record with voting instructions, your shares may constitute broker non-votes. The effect of broker non-votes is more specifically described in “What vote is required to approve the Charter Amend Proposal?” below.

What vote is required to approve the Charter Amend Proposal?

The holders of a majority of our Common Stock outstanding on the record date must be present, in person or by proxy, at the Special Meeting in order to have the required quorum for the transaction of business. Pursuant to Nevada corporate law, abstentions and broker non-votes will be counted for the purpose of determining whether a quorum is present.

-3-

Assuming that a quorum is present, the following votes will be required:

| · | Proposal 1 or the Charter Amendment Proposal: The proposal to increase the number of authorized shares of our Common Stock from 300,000,000 to 800,000,000 shares will be approved if it receives the affirmative vote of a majority of the eligible shares held by the stockholders entitled to vote in person or by proxy. Abstentions and broker non-votes will have the same effect as a vote against the proposal. |

Holders of the Common Stock will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the Special Meeting.

What are “broker non-votes”?

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, your shares are held by your broker, bank or other agent as your nominee, or in “street name,” and you will need to obtain a proxy form from the organization that holds your shares and follow the instructions included on that form regarding how to instruct the organization to vote your shares.

Banks, brokers and other agents acting as nominees are permitted to use discretionary voting authority to vote proxies for proposals that are deemed “routine” by the New York Stock Exchange, but are not permitted to use discretionary voting authority to vote proxies for proposals that are deemed “non-routine” by the New York Stock Exchange. A broker “non-vote” occurs when a proposal is deemed “non-routine” and a nominee holding shares for a beneficial owner does not have discretionary voting authority with respect to the matter being considered and has not received instructions from the beneficial owner.

The determination of which proposals are deemed “routine” versus “non-routine” may not be made by the New York Stock Exchange until after the date on which this proxy statement has been mailed to you. As such, it is important that you provide voting instructions to your bank, broker or other nominee, if you wish to determine the voting of your shares. If the New York Stock Exchange determines the Charter Amendment Proposal to be “non-routine,” a failure to vote, or to instruct your broker how to vote any shares held for you in your broker’s names will have the same effect as a vote against the proposal.

How are we soliciting this proxy?

We are soliciting this proxy on behalf of our Board and will pay all expenses associated therewith. Some of our officers, directors and other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, facsimile or other electronic means.

We have also retained Alliance Advisors LLC to assist it in the solicitation of proxies and the hosting of our virtual Special Meeting. Alliance Advisors LLC will solicit proxies our behalf from individuals, brokers, bank nominees and other institutional holders in the same manner described above, and provide the infrastructure to host and manage the Special Meeting. Alliance Advisors LLC will receive a fee of $8,500, plus approved and reasonable out of pocket expenses, for its services for the solicitation of the proxies and the hosting of our Special Meeting. We have also agreed to indemnify Alliance Advisors LLC against certain claims.

Whom You Should Call with Questions:

If you have further questions, you may contact the Company’s proxy solicitor, Alliance Advisors, LLC at:

Alliance Advisors, LLC

200 Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

(855) 973-0093

-4-

PROPOSAL 1: PROPOSAL TO INCREASE THE COMPANY’S AUTHORIZED CAPITAL TO 800,000,000 SHARES OF COMMON STOCK

The Board believes it is in the best interest of the Company to increase the number of shares of Common Stock authorized for issuance by 500,000,000 shares of Common Stock, bringing the total number of shares of Common Stock authorized from 300,000,000 shares to 800,000,000 shares. The form of Amended and Restated Articles of Incorporation (the “Amendment”) to be filed with the Nevada Secretary of State is set forth as Exhibit A to this Proxy Statement (subject to any changes required by applicable law). This proposal to increase the number of shares of Common Stock authorized for issuance, if approved at the Special Meeting, will become effective and the Company’s number of shares of authorized Common Stock will be increased to 800,000,000 shares upon the filing of the Amendment to be filed with the Nevada Secretary of State. The following discussion is qualified in its entirety by the full text of the Amendment, which is attached to this Proxy Statement as Exhibit A and is incorporated herein by reference.

The Board believes that it is desirable to have sufficient authorized shares of Common Stock available for future financings to raise the capital needed to operate its business, and for possible additional future acquisition transactions, joint ventures and other general corporate purposes. The Board believes that having such authorized shares of Common Stock available for issuance in the future will give the Company greater flexibility and may allow such shares to be issued without the expense and delay of a stockholder meeting to authorize the issuance of additional shares. Although such issuance of additional shares with respect to future financings and acquisitions would dilute existing stockholders, management believes that such transactions would increase the overall value of the Company to its stockholders. There are certain advantages and disadvantages of an increase in authorized Common Stock. The advantages include:

| • | The ability to raise additional capital by issuing capital stock under the type of transactions described above, or other financing transactions. |

| • | To have shares of Common Stock available to finance the Company’s ongoing operating capital requirements to continue the further development and commercialization of the Company’s lead product candidate, AC5TM, and to pursue other potential business expansion opportunities, if any. |

The disadvantages include:

| • | Stockholders will experience further dilution of their ownership. |

| • | Stockholders do not have any preemptive or similar rights to subscribe for or purchase any additional shares of Common Stock that may be issued in the future, and therefore, future issuances of Common Stock may, depending on the circumstances, have a dilutive effect on the earnings per share, voting power and other interests of existing stockholders of the Company. |

| • | The additional shares of Common Stock for which authorization is sought in this proposal would be part of the existing class of Common Stock and, if and when issued, would have the same rights and privileges as the shares of Common Stock presently outstanding. The Company intends to use the proceeds from any future capital raises for working capital and general corporate purposes. The Company has no arrangements, agreements, or understandings in place at the present time for the issuance or use of the additional shares of Common Stock to be authorized by the proposed Amendment. However, the Company has recently conducted certain public and private offerings of Common Stock and warrants, and the Company will continue to require additional capital in the near future to fund its operations. As a result, it is foreseeable that the Company will seek to issue such additional shares of Common Stock in connection with any such capital raising activities. The Board does not intend to issue any Common Stock or securities convertible into Common Stock except on terms that the Board deems to be in the best interests of the Company and its stockholders. |

| • | The issuance of authorized but unissued stock could be used to deter a potential takeover of the Company that may otherwise be beneficial to stockholders by diluting the shares held by a potential suitor or issuing shares to a stockholder that will vote in accordance with the Board’s desires. A takeover may be beneficial to independent stockholders because, among other reasons, a potential suitor may offer such stockholders a premium for their shares of stock compared to the then-existing market price. The Company does not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover consequences. |

-5-

Although an increase in the authorized shares of Common Stock could, under certain circumstances, have an anti-takeover effect, this proposal to adopt the amendment is not in response to any effort, of which the Company is aware, to accumulate Common Stock or obtain control of the Company. Nor is it part of a plan by management to recommend a series of similar amendments to the Board and stockholders. The Company has no arrangements, agreements, or understandings in place at the present time to enter into any merger, consolidation, acquisition or similar business transaction.

If the Company’s stockholders do not approve the increase in authorized shares of Common Stock, then the Company will be limited in its ability to use shares of Common Stock for financing, acquisitions, or other general corporate purposes. As of May 22, 2020, the Company only had 44,270,404 shares of Common Stock authorized and unreserved for issuance, which would be available for such purposes.

Vote Required and Board Recommendation

This proposal must be approved by the affirmative vote of a majority of the outstanding shares of Common Stock of the Company entitled to vote on the proposal. Shares that are not represented at the Special Meeting and abstentions and, if this proposal is deemed to be “non-routine” as described above under “What are “broker non-votes”? on page 4, broker non-votes with respect to this proposal, will have the same practical effect as a vote against this proposal.

The Board recommends that stockholders vote “FOR” the proposal to increase the Company’s authorized capital to 800,000,000 shares of Common Stock.

STOCK OWNERSHIP BY PRINCIPAL STOCKHOLDERS, DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information regarding the beneficial ownership of our Common Stock by (i) each person who, to our knowledge, beneficially owns more than 5% of our Common Stock; (ii) each of our directors and named executive officers; and (iii) all of our directors and executive officers as a group. Unless otherwise indicated in the footnotes to the following table, the address of each person named in the table is: c/o Arch Therapeutics, Inc., 235 Walnut St., Suite #6, Framingham, Massachusetts 01702. The information set forth in the table below is based on 187,862,947 shares of our Common Stock outstanding on May 22, 2020. Shares of our Common Stock subject to options, warrants, or other rights currently exercisable or exercisable within 60 days of May 22, 2020 are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the person holding such options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other person. The following table is presented after taking into account the ownership limitations to which certain holders of our Series D Warrants and Series E Warrants, and all the holders of our Series F Warrants, Series G Warrants, Series H Warrants, Series I Warrants and Placement Agent Warrants are subject to (the “Ownership Limitation”). In general, the Ownership Limitation prevents holders from exercising the warrant to the extent such exercise would result in the holder owning more shares than the Ownership Limitation, which is initial set below 5%, and such Ownership Limitation may be waived at the holder’s discretion, provided that such waiver will not become effective until the 61st day after delivery of such waiver notice.

| Name of Beneficial Owner | Number of Shares Beneficially Owned | Percentage of Shares Beneficially Owned (1) | ||||||

| 5%+ Stockholders: | ||||||||

| Twelve Pins Partners (2) | 10,000,000 | 5.32 | % | |||||

| Ana B. Parker (3) | 14,244,291 | 7.58 | % | |||||

| Directors and Executive Officers | ||||||||

| Terrence Norchi (4) | 17,379,909 | 9.07 | % | |||||

| James R. Sulat (5) | 2,845,143 | 1.50 | % | |||||

| Punit Dhillon (6) | 400,000 | 0.21 | % | |||||

| Richard E. Davis (7) | 3,186,333 | 1.68 | % | |||||

| Current Directors and Named Executive Officers as a Group (4 persons) | 23,811,386 | 12.16 | % | |||||

-6-

Shares of our Common Stock subject to options, warrants, or other rights currently exercisable or exercisable within 60 days of May 22, 2020, are deemed to be beneficially owned and outstanding for computing the share ownership and percentage of the person holding such options, warrants or other rights, but are not deemed outstanding for computing the percentage of any other person.

| (1) | Except as otherwise indicated, we believe that each of the beneficial owners of the Common Stock listed previously, based on information furnished by such owners, has sole investment and voting power with respect to the shares listed as beneficially owned by such owner, subject to community property laws where applicable. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. |

| (2) | Dr. Norchi is the sole member of Twelve Pins Partners, LLC and has sole voting and investment control with respect to the shares it holds. Dr. Norchi disclaims beneficial ownership of these securities except to the extent of his pecuniary interest therein. |

| (3) | Represents (i) 7,863,400 shares of Common Stock owned individually by Ana Parker; (ii) 1,380,891 shares of Common Stock owned individually by Michael A. Parker, Ana Parker’s spouse; and (iii) 5,000,000 shares of Common Stock owned through Tungsten III LLC, of which Michael Parker is the sole manager. Excludes 4,500,000 shares of Common Stock that may be acquired upon the exercise of Series D Warrants (which expire on June 30, 2020), any of the 1,583,334 shares of Common Stock that may be acquired upon the exercise of Series E Warrants (which expire May 26, 2021), any of the 600,000 shares of Common Stock that may be acquired upon the exercise of Series G Warrants (which expire July 7, 2023), any of the 1,230,769 shares of Common Stock that may be acquired upon the exercise of Series H Warrants (which expire May 14, 2024) or any of the 3,428,571 shares of Common Stock that may be acquired upon the exercise of Series I Warrants (which expire October 18, 2024), since such warrants cannot be exercised until such time as the holder would not beneficially own, after such exercise, more than 4.9% of the outstanding shares of Common Stock; provided, however, that the holder may waive such ownership limitation, in which case such waiver will become effective sixty-one (61) days after the holder’s delivery of such waiver notice. As of May 22, 2020, Ms. Parker has not waived such limitation. |

| (4) | Represents (a) 10,000,000 shares of our Common Stock held by Twelve Pins Partners, LLC, with respect to which Dr. Norchi holds sole voting and investment control; (b) 1,419,076 shares issued to Dr. Norchi upon the closing of the Merger in exchange for the cancellation of shares of Common Stock and convertible notes of ABS owned by him immediately prior to the closing of the Merger; (c) 1,130,000 shares of restricted stock granted to Dr. Norchi on May 3, 2016; (d) 650,000 shares of restricted stock granted to Dr. Norchi on February 3, 2017;(e) 360,000 shares of restricted stock granted to Dr. Norchi on July 19, 2018; and (f) 3,820,833 shares subject to options exercisable within 60 days after May 22, 2020. Dr. Norchi disclaims beneficial ownership of the securities held by Twelve Pins Partners, LLC except to the extent of his pecuniary interest therein. |

| (5) | Represents (a) 370,000 shares of our Common Stock directly held by Mr. Sulat; (b) 922,267 shares of our Common Stock held by the Keyes Sulat Revocable Trust; (c) 41,666 shares of our Common Stock held by the Brenna Keyes Sulat Irrevocable Trust; (d) 41,666 shares of our Common Stock held by the Nathaniel Keyes Sulat Irrevocable Trust; (e) a Series D Warrant exercisable for 454,546 shares of our Common Stock, a Series E Warrant exercisable for 83,333 shares of our Common Stock and a Series F Warrant exercisable for 45,833 shares of our Common stock, in each case held by Keyes Sulat Revocable Trust; (f) a Series F Warrant exercisable for 22,916 shares of our Common stock held by the Brenna Keyes Sulat Irrevocable Trust; (g) a Series F Warrant exercisable for 22,916 shares of our Common stock held by the Nathaniel Keyes Sulat Irrevocable Trust; and (h) 840,000 shares subject to options exercisable within 60 days after May 22, 2020. Mr. Sulat disclaims beneficial ownership of the securities held by Keyes Sulat Revocable Trust, Brenna Keyes Sulat Irrevocable Trust and Nathaniel Keyes Sulat Irrevocable Trust except, in each case, to the extent of his pecuniary interest therein. |

| (6) | Represents 400,000 shares of our Common Stock subject to options exercisable within 60 days after May 22, 2020. |

| (7) | Represents (a) 103,000 of our restricted Common Stock granted to Mr. Davis on May 3, 2016; (b) 500,000 shares our restricted Common Stock granted to Mr. Davis on February 3, 2017; (c) 275,000 shares our restricted Common Stock granted to Mr. Davis on July 19, 2018; and (d) 2,308,333 shares of our Common Stock subject to options exercisable within 60 days after May 22, 2020. |

-7-

Proposals of Stockholders for Stockholder Meetings

Our Bylaws contain an advance notice provision that requires that all business proposed by a stockholder that will be conducted or considered at a meeting must meet notice requirements. Accordingly, for business to be properly submitted by a stockholder for a vote at a stockholder meeting, the stockholder must (i) be a stockholder of record as of the record date for such meeting; (ii) be entitled to vote at such meeting; and (iii) have given timely notice in writing of the proposal to be submitted by the stockholder for a vote. To be timely, the stockholder’s notice must be delivered to the Secretary at the Company’s principal executive office at the following address: 235 Walnut Street, Suite 6, Framingham, MA 01702 no later than the close of business on the later of the 90th day prior to the stockholder meeting or the 15th day following the day on which public announcement of the date of such stockholder meeting is first made.

A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before a stockholder meeting the information set forth in Section 2.8 and/or Section 2.9 of the Company’s Bylaws, including but not limited to: (i) a description in reasonable detail of the business desired to be brought before the stockholder meeting and the reasons for conducting such business at the stockholder meeting, (ii) the name and address, as they appear on the Company’s books, of the stockholder proposing such business and of the beneficial owner, if any, on whose behalf the proposal is made, (iii) such information regarding each director nominee or each matter of business to be proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the U. S. Securities and Exchange Commission, or the SEC, had the nominee been nominated, or intended to be nominated, or the matter been proposed, or intended to be proposed by the Board; (iv) if applicable, the consent of each nominee to be named in the proxy statement and to serve as director of the Company if so elected; (v) the class and number of shares of the Company that are owned beneficially and of record by the stockholder proposing such business and by the beneficial owner, if any, on whose behalf the proposal is made, and (vi) any material interest of such stockholder proposing such business and the beneficial owner, if any, on whose behalf the proposal is made in such business.

In addition, if you want to submit a Rule 14a-8 proposal for inclusion in our proxy statement for a stockholder meeting, you may do so by following the procedures in Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion, Rule 14a-8 stockholder proposals must be delivered to the Secretary at the Company’s principal executive office no later than the close of business on the later of the 90th day prior to the stockholder meeting or the 15th day following the day on which public announcement of the date of such stockholder meeting is first made.

Management is not aware of any matters to be brought before the Special Meeting other than those discussed above.

Householding of Special Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements. This means that only one copy of this Proxy Statement may have been sent to multiple stockholders in the same household. We will promptly deliver a separate copy of this Proxy Statement to any stockholder upon written or oral request to Arch Therapeutics Inc., 235 Walnut Street, Suite 6, Framingham, MA 01702, Attention: Secretary, or by phone at 877-777-2857. Any stockholder who wants to receive a separate copy of this Proxy Statement, or of the Company’s proxy statements or annual reports in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact the stockholder’s bank, broker, or other nominee record holder, or the stockholder may contact us at the address and phone number above.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 1, 2020

A copy of this Proxy Statement, the enclosed proxy card, together with directions to the Special Meeting, can be found at the website address: http://viewproxy.com/arth/2020.

-8-

2020 SPECIAL MEETING OF STOCKHOLDERS

This proxy is solicited on behalf of the Board of Directors of Arch Therapeutics, Inc.

The undersigned hereby appoints Terrence W. Norchi and Richard E. Davis as proxies and attorneys-in-fact, with full power of substitution, and hereby authorizes them, or either of them, to represent and to vote, as designated below, all the shares of the common stock of Arch Therapeutics, Inc. held of record by the undersigned at the close of business on May 26, 2020, at the special meeting of stockholders to be held on July 1, 2020, at 10:00 am, Eastern Standard Time, via live webcast, or any adjournments or postponements thereof, with all powers which the undersigned would possess if present at the meeting. In order to attend the virtual meeting you must register at http://viewproxy.com/arth/2020.

This proxy, when properly executed, will be voted in the manner directed by the undersigned stockholder. If no direction is provided, the proxies named above will vote FOR Proposal 1.

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournments or postponements thereof.

The undersigned acknowledges receipt of the Notice of Special Meeting of Stockholders and accompanying Proxy Statement and revokes all prior proxies for the meeting. Please date and sign exactly as name(s) appear(s) hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

Please mark, sign, date and return the proxy using the enclosed envelope.

t PLEASE DETACH ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED. t

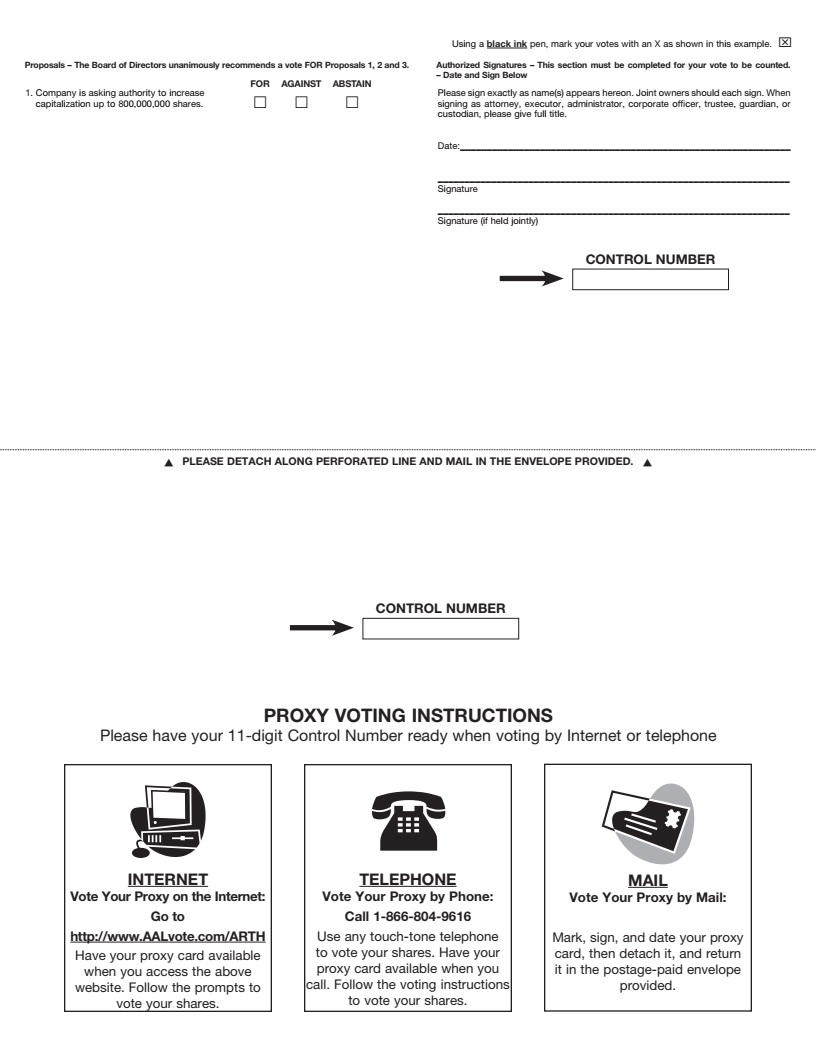

Proposals – The Board of Directors unanimously recommends a vote FOR Proposals 1, 2 and 3.

1. Company is asking authority to increase FOR AGAINST ABSTAIN

£ £ £

capitalization up to 800,000,000 shares.

Using a black ink pen, mark your votes with an X as shown in this example. x

Authorized Signatures – This section must be completed for your vote to be counted.

– Date and Sign Below

Please sign exactly as name(s) appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, corporate officer, trustee, guardian, or custodian, please give full title.

Date:______________________________________________________________

__________________________________________________________________

Signature

__________________________________________________________________

Signature (if held jointly)

CONTROL NUMBER

t PLEASE DETACH ALONG PERFORATED LINE AND MAIL IN THE ENVELOPE PROVIDED. t

CONTROL NUMBER

PROXY VOTING INSTRUCTIONS

Please have your 11-digit Control Number ready when voting by Internet or telephone

INTERNET

Vote Your Proxy on the Internet: Go to http://www.AALvote.com/ARTH

Have your proxy card available when you access the above website. Follow the prompts to vote your shares.

TELEPHONE

Vote Your Proxy by Phone: Call 1-866-804-9616

Use any touch-tone telephone to vote your shares. Have your proxy card available when you call. Follow the voting instructions to vote your shares.

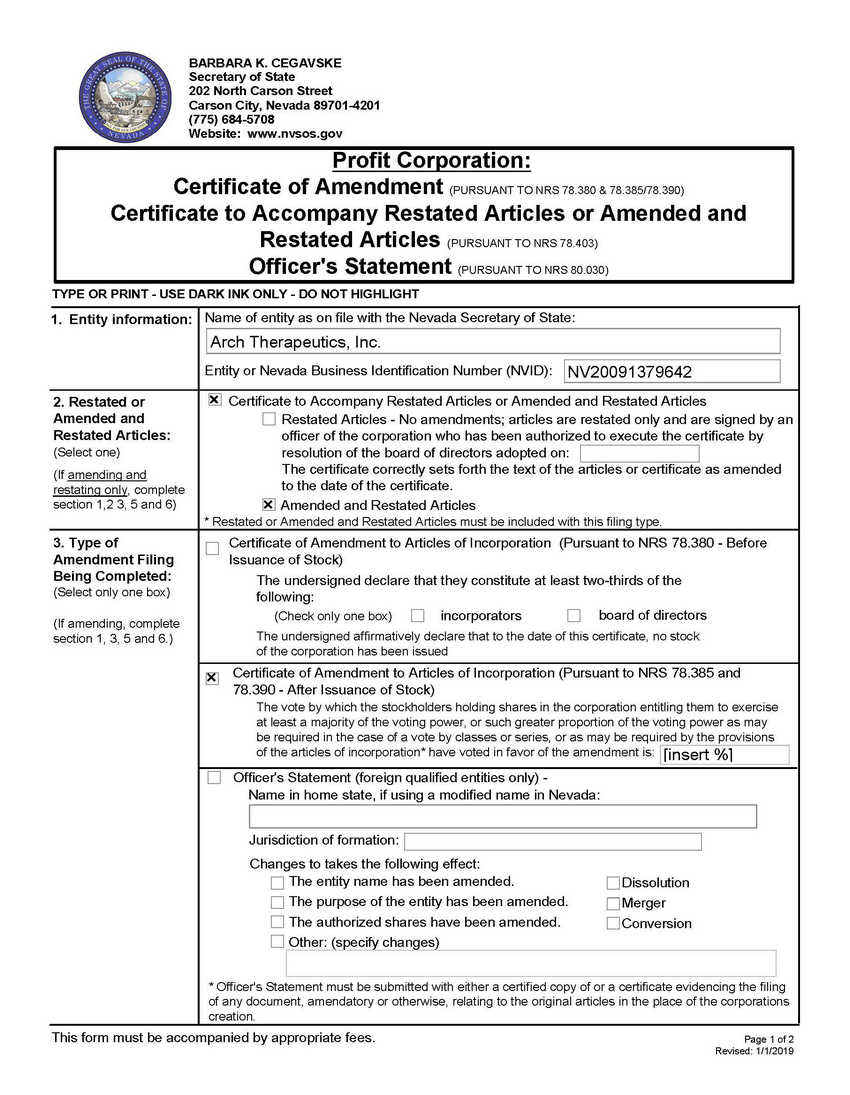

Exhibit A

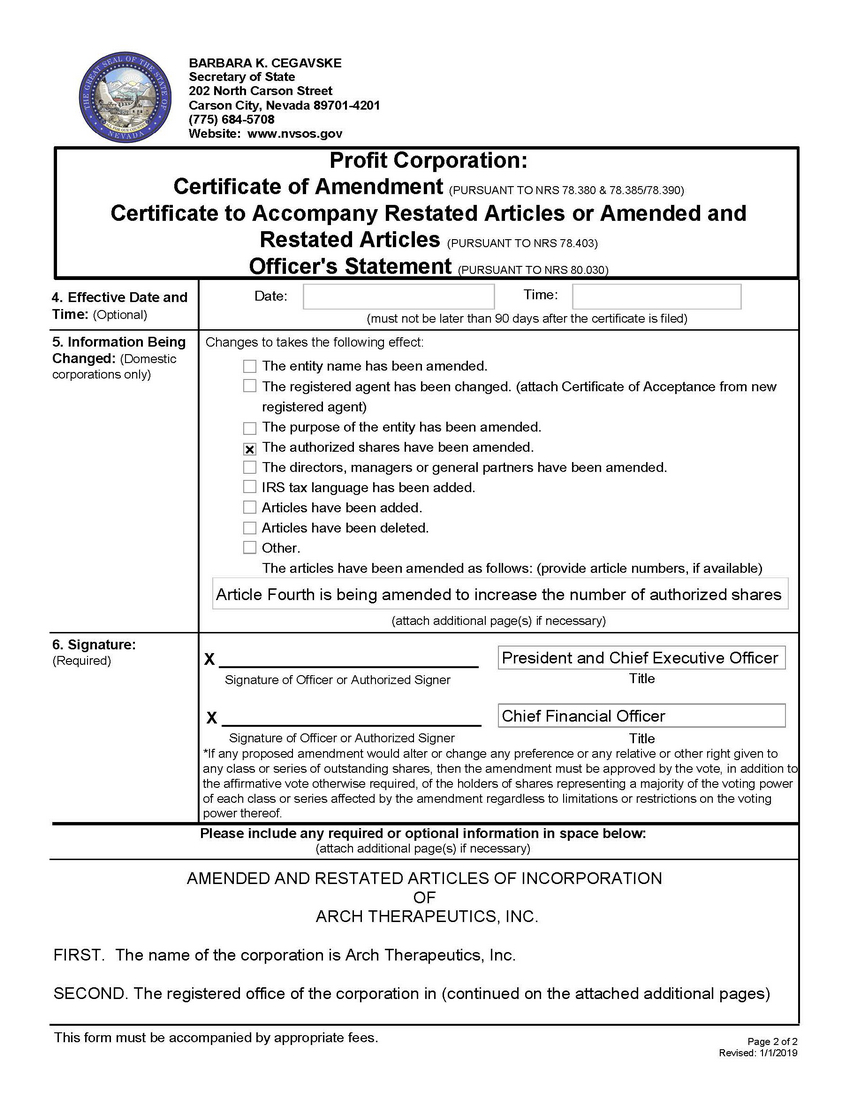

BARBARA K. CEGAVSKE Secretary of State

202 North Carson Street Carson City, Nevada 89701-4201 (775) 684-5708

Website: www.nvsos.gov

Profit Corporation:

Certificate of Amendment (PURSUANT TO NRS 78.380 & 78.385/78.390)

Certificate to Accompany Restated Articles or Amended and

Restated Articles (PURSUANT TO NRS 78.403)

Officer's Statement (PURSUANT TO NRS 80.030)

TYPE OR PRINT - USE DARK INK ONLY - DO NOT HIGHLIGHT

1. Entity information: Name of entity as on file with the Nevada Secretary of State:

Arch Therapeutics, Inc.

Entity or Nevada Business Identification Number (NVID): NV20091379642

2. Restated or Certificate to Accompany Restated Articles or Amended and Restated Articles

Amended and Restated Articles - No amendments; articles are restated only and are signed by an

Restated Articles: officer of the corporation who has been authorized to execute the certificate by

(Select one) resolution of the board of directors adopted on:

(If amending and The certificate correctly sets forth the text of the articles or certificate as amended

to the date of the certificate.

restating only, complete

section 1,2 3, 5 and 6) Amended and Restated Articles

* Restated or Amended and Restated Articles must be included with this filing type.

3. Type of Certificate of Amendment to Articles of Incorporation (Pursuant to NRS 78.380 - Before

Amendment Filing Issuance of Stock)

Being Completed: The undersigned declare that they constitute at least two-thirds of the

(Select only one box) following: board of directors

(If amending, complete (Check only one box) incorporators

The undersigned affirmatively declare that to the date of this certificate, no stock

section 1, 3, 5 and 6.)

of the corporation has been issued

Certificate of Amendment to Articles of Incorporation (Pursuant to NRS 78.385 and

78.390 - After Issuance of Stock)

The vote by which the stockholders holding shares in the corporation entitling them to exercise

at least a majority of the voting power, or such greater proportion of the voting power as may

be required in the case of a vote by classes or series, or as may be required by the provisions

of the articles of incorporation* have voted in favor of the amendment is: [insert %]

Officer's Statement (foreign qualified entities only) -

Name in home state, if using a modified name in Nevada:

Jurisdiction of formation:

Changes to takes the following effect:

The entity name has been amended. Dissolution

The purpose of the entity has been amended. Merger

The authorized shares have been amended. Conversion

Other: (specify changes)

* Officer's Statement must be submitted with either a certified copy of or a certificate evidencing the filing

of any document, amendatory or otherwise, relating to the original articles in the place of the corporations

creation.

BARBARA K. CEGAVSKE Secretary of State

202 North Carson Street Carson City, Nevada 89701-4201 (775) 684-5708

Website: www.nvsos.gov

Profit Corporation:

Certificate of Amendment (PURSUANT TO NRS 78.380 & 78.385/78.390)

Certificate to Accompany Restated Articles or Amended and

Restated Articles (PURSUANT TO NRS 78.403)

Officer's Statement (PURSUANT TO NRS 80.030)

4. Effective Date and Date: Time:

Time: (Optional)

(must not be later than 90 days after the certificate is filed)

5. Information Being Changes to takes the following effect:

Changed: (Domestic The entity name has been amended.

corporations only)

The registered agent has been changed. (attach Certificate of Acceptance from new

registered agent)

The purpose of the entity has been amended.

The authorized shares have been amended.

The directors, managers or general partners have been amended.

IRS tax language has been added.

Articles have been added.

Articles have been deleted.

Other.

The articles have been amended as follows: (provide article numbers, if available)

Article Fourth is being amended to increase the number of authorized shares

(attach additional page(s) if necessary)

6. Signature:

X ____________________________ President and Chief Executive Officer

(Required)

Signature of Officer or Authorized Signer Title

X ____________________________ Chief Financial Officer

Signature of Officer or Authorized Signer Title

*If any proposed amendment would alter or change any preference or any relative or other right given to

any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to

the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power

of each class or series affected by the amendment regardless to limitations or restrictions on the voting

power thereof.

Please include any required or optional information in space below:

(attach additional page(s) if necessary)

AMENDED AND RESTATED ARTICLES OF INCORPORATIONOF

ARCH THERAPEUTICS, INC.

FIRST. The name of the corporation is Arch Therapeutics, Inc.

SECOND. The registered office of the corporation in (continued on the attached additional pages)

Profit Corporation:

Certificate to Accompany Restated Articles or Amended and Restated Articles

(PURSUANT TO NRS 78.403)

(Additional Pages)

AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF

ARCH THERAPEUTICS, INC.

FIRST. The name of the corporation is Arch Therapeutics, Inc.

SECOND. The registered office of the corporation in the State of Nevada is located at 311 S. Division Street, Carson City, Nevada 89703. The corporation may maintain an office, or offices, in such other place within or without the State of Nevada as may be from time to time designated by the Board of Directors or by the By- Laws of the corporation. The corporation may conduct all corporation business of every kind and nature outside the State of Nevada as well as within the State of Nevada.

THIRD. The objects for which this corporation is formed are to engage in any lawful activity, including, but not limited to the following:

| a) | Shall have such rights, privileges and powers as may be conferred upon corporations by any existing law. |

| b) | May at any time exercise such rights, privileges and powers, when not inconsistent with the purposes and objects for which this corporation is organized. |

| c) | Shall have power to have succession by its corporate name for the period limited in its certificate or articles of incorporation, and when no period is limited, perpetually, or until dissolved and its affairs wound up according to law. |

| d) | Shall have power to sue and be sued in any court of law or equity. |

| e) | Shall have power to make contracts. |

| f) | Shall have power to hold, purchase and convey real estate and personal estate and to mortgage or lease any such real and personal estate with its franchises. The power to hold real and personal estate shall include the power to take the same by devise or bequest in the State of Nevada, or in any other state, territory or country. |

| g) | Shall have power to appoint such officers and agents as the affairs of the corporation shall require, and to allow them suitable compensation |

| h) | Shall have the power to make By-Laws not inconsistent with the constitution or laws of the United States, or of the State of Nevada, for the management, regulation and government of its affairs and property, the transfer of its stock, the transaction of its business, and the calling and holding of meetings of its stockholders. |

| i) | Shall have power to wind up and dissolve itself, or be wound up or dissolved. |

| j) | Shall have power to adopt and use a common seal or stamp, and alter the same at pleasure. The use of a seal or stamp by the corporation on any corporate documents is not |

necessary. The corporation may use a seal or stamp, if it desires, but such use or nonuse shall not in any way affect the legality of the document.

| k) | Shall have the power to borrow money and contract debts when necessary for the transaction of its business, or for the exercise of its corporate rights, privileges or franchises, or for any other lawful purpose of its incorporation; to issue bonds, promissory notes, bills of exchange, debentures, and other obligations and evidences of indebtedness, payable at a specified time or times, or payable upon the happening of a specified event or events, whether secured by mortgage, pledge or otherwise, or unsecured, for money borrowed, or in payment for property purchased, or acquired, or for any other lawful object. |

| l) | Shall have power to guarantee, purchase, hold, sell, assign, transfer, mortgage, pledge or otherwise dispose of the shares of the capital stock of, or any bonds, securities or evidences of indebtedness created by, any other corporation or corporations of the State of Nevada, or any other state or government, and, while owners of such stock, bonds, securities or evidences of indebtedness, to exercise all rights, powers and privileges of ownership, including the right to vote, if any. |

| m) | Shall have the power to purchase, hold, sell and transfer shares of its own capital stock, and use therefore its capital, capital surplus, surplus, or other property to fund. |

| n) | Shall have power to conduct business, have one or more offices, and conduct any legal activity in the State of Nevada, and in any of the several states, territories, possessions and dependencies of the United States, District of Columbia, and any foreign countries. |

| o) | Shall have power to do all and everything necessary and proper for the accomplishment of the objects enumerated in its certificate or articles of incorporation, or any amendment thereof, or necessary or incidental to the protection and benefit of the corporation, and, in general, to carry on any lawful business necessary or incidental to the attainment of the objects of the corporation, whether or not such business is similar in nature to the objects set forth in the certificate or Restated Articles of Incorporation of the corporation, or any amendments thereof. |

| p) | Shall have power to make donations for the public welfare or for charitable, scientific or educational purposes. |

| q) | Shall have power to enter into partnerships, general or limited, or joint ventures, in connection with any lawful activities, as may be allowed by law. |

FOURTH. The amount of total authorized capital stock of the corporation is Eight Hundred Million (800,000,000) shares of common stock, par value $0.001 per share.

FIFTH. The governing board of the corporation shall be known as directors, and the number of directors may from time to time be increased or decreased in such manner as shall be provided by the By-Laws of this corporation, providing that the number of directors shall not be reduced to fewer than one (1).

The first Board of Directors shall be one (1) in number and the name and post office address of the Director shall be listed as follows:

[Omitted per NRS 78.403(3)(b) (past board member information)]

-2-

SIXTH. The capital stock, after the amount of the subscription price, or par value, has been paid in, shall not be subject to assessment to pay the debts of the corporation.

SEVENTH. [Omitted per NRS 78.403(3)(a) (incorporator information)]

EIGHTH. [Omitted per NRS 78.403(3)(c) (registered agent information)]

NINTH. The corporation is to have a perpetual existence.

TENTH. In furtherance and not in limitation of the powers conferred by the statute, the Board of Directors is expressly authorized:

| a) | Subject to the By-Laws, if any, adopted by the Stockholders, to make, alter or amend the By-Laws of the corporation. |

| b) | To fix the amount to be reserved as working capital over and above its capital stock paid in; to authorize and cause to be executed, mortgages and liens upon the real and personal property of this corporation. |

| c) | By resolution passed by a majority of the whole Board, to designate one (1) or more committees, each committee to consist of one or more Directors of the corporation, which, to the extent provided in the resolution, or in the By-Laws of the corporation, shall have and may exercise the powers of the Board of Directors in the management of the business and affairs of the corporation. Such committee, or committees, shall have such name, or names as may be stated in the By-Laws of the corporation, or as may be determined from time to time by resolution adopted by the Board of Directors. |

| d) | When and as authorized by the affirmative vote of the Stockholders holding stock entitling them to exercise at least a majority of the voting power given at a Stockholders meeting called for that purpose, or when authorized by the written consent of the holders of at least a majority of the voting stock issued and outstanding, the Board of Directors shall have power and authority at any meeting to sell, lease or exchange all of the property and assets of the corporation, including its good will and its corporate franchises, upon such terms and conditions as its Board of Directors deems expedient and for the best interests of the corporation. |

ELEVENTH. No shareholder shall be entitled as a matter of right to subscribe for or receive additional shares of any class of stock of the corporation, whether now or hereafter authorized, or any bonds, debentures or securities convertible into stock, but such additional shares of stock or other securities convertible into stock may be issued or disposed of by the Board of Directors to such persons and on such terms as in its discretion it shall deem advisable.

TWELFTH. No director or officer of the corporation shall be personally liable to the corporation or any of its stockholders for damages for breach of fiduciary duty as a Director or Officer involving any act or omission of any such Director or Officer; provided, however, that the foregoing provision shall not eliminate or limit the liability of a Director or Officer (i) for acts or omissions which involve intentional misconduct, fraud or a knowing violation of law; or (ii) the payment of dividends in violation of Section 78.300 of the Nevada Revised Statutes. Any repeal or modification of this Article by the Stockholders of this corporation shall be prospective only,

-3-

and shall not adversely affect any limitation on the personal liability of a Director or Officer of the corporation for acts or omissions prior to such repeal or modification.

THIRTEENTH. The corporation reserves the right to amend, alter, change or repeal any provision contained in the Restated Articles of Incorporation, in the manner now or hereafter

prescribed by statute, or by the Restated Articles of Incorporation, and all rights conferred upon the Stockholders herein are granted subject to this reservation.

IN WITNESS WHEREOF, the undersigned have executed these Restated Articles this ____th day of , 2020.

| /s/ Terrence W. Norchi, MD | |

| President and CEO |

-4-